Upcoming IPOs for 2022

Initial public offerings (IPOs) are a way for private companies to raise money, by offering their shares to the public on the stock market. This is an important time for private companies to become more widely available and allow investment access to the public.

Upcoming IPOs can benefit private investors in particular. This is because many IPO companies will include share premiums for their existing investors, so this can result in potential profits. Existing shareholders of a private company could include family, friends, and professional investors such as venture capitalists. These private equity investors help to finance companies with high growth potential in exchange for a stake in their equity.

What is the process?

An initial public offering (IPO) happens when shares of a previously private company are offered to the public on a stock exchange. This is part of a new stock issuance. A company that is planning an IPO will select underwriters to manage their financial risk, and chooses a stock exchange in which to feature their newly public shares. When the company goes public, the private shareholders’ shares will value at the same price as the public share. These are usually a higher value and therefore, they will profit from the relative returns that were expected.

In general, companies can register for an upcoming IPO after reaching a market capitalisation of $1bn, which is the same for a ‘unicorn company’. However, as long as the business can meet the listing requirements for a specific market and prove their potential for future profit, they can also qualify for an IPO.

Alternatively, an increasing number of businesses are choosing to use a special-purpose acquisition company (SPAC) as it may offer a slightly cheaper and quicker process.

One of the advantages of IPOs is the ability to raise even more capital in the future. A secondary offering after the initial public offering releases the sale of new stock on the exchange, in order to raise more funds for operations. This, in turn, dilutes the percentage of individual ownership for the original investors, which can cause negative investor sentiment. This will also reduce the quality of important company fundamentals, such as company earnings and P/E ratios for the share price.

Upcoming IPOs to watch

- Reddit IPO: Online social network and message board Reddit has just hired its first CFO as it prepares go public on the stock market. The current value of the company is around $6 billion and it plans to expand the business even further with the funding that it receives from the IPO, which may occur in 2022. Reddit's IPO comes at a convenient time for the company, after traders of the forum sparked a rally in January 2021 of shorted stocks such as Gamestop and AMC, causing a short squeeze for the former company.

- Brewdog IPO: Craft-beer brewer BrewDog is a British company that has repeated its plans for an IPO on the London Stock Exchange at some point in 2022. The company previously announced its plans in 2018 but has been waiting for the right time to debut its shares to the public. BrewDog's IPO could value the company at over £1 billion.

- Kraken IPO: American cryptocurrency exchange Kraken is expected to debut its shares on the stock market in 2022, being the second US-based crypto stock to register on an exchange. The company is reportedly tied between having a traditional IPO or using a special-purpose acquisition company (SPAC), although it may have too high of a value for the latter and therefore, it would be more likely consider a direct listing. Kraken is currently valued at around $4 billion but this could rise to $20 billion after its next funding round.

- Stripe IPO: Digital payments provider Stripe is planning a direct listing as it doesn't need to raise money, it has been reported. The company is backed by Elon Musk and serves clients such as Google, Amazon and Zoom, and it has been hailed as one of the world's most valuable start-ups. It was last valued at $95bn in a fundraising round in March 2021.

- Instacart IPO: Online grocery delivery service Instacart is currently valued at $39bn and could be even more when it debuts on the stock market later in 2022. It hasn't yet announced whether it will opt for a traditional IPO or direct listing. The company has raised $265m in private fundraising this year, thanks to the rise in online grocery shopping due to Covid-19.

- Starlink IPO: Elon Musk's satellite constellation is due to IPO as a spin-off from parent company SpaceX, although it is unknown when the company plans to do this, as Musk is looking for "more predictable cash flows" first. The company is valued at around $42bn or potentially higher, currently generating annual revenues of $10bn.

- Monzo IPO: British online bank Monzo is joining the fleet of UK tech companies to debut on the stock market between 2021 and 2022. The unicorn start-up was originally valued at £2bn in 2019 but this was slashed to £1.24bn in 2020 after a fundraising round. CEO TS Anil believes that this figure is undervalued and Monzo could be worth a lot more, so keep an eye out for updates.

- Virgin Atlantic IPO: Richard Branson is planning an IPO to help its airline company recover from the pandemic, with expected losses of £1bn throughout the period. The stock will most likely list on the London Stock Exchange and could happen as early as 2022.

- Houzz IPO: American home design website and community Houzz's IPO is eagerly awaited by investors, and there is speculation that the company could choose either an IPO or SPAC route at some point in 2022. Despite dismissing around 10% of its staff last year, the housing sector has experienced new highs in 2021 and Houzz raised $400m in 2017, with an estimated valuation of $4bn.

- Polestar IPO: Swedish EV manufacturer Polestar, which is a part of the Volvo and Geely group, is planning a SPAC merger with Gores Guggenheim, which should take place at the end of September. The SPAC raised $800m in a fundraising round in May 2021 and the company is expected to be valued at over $20bn, given the rising trend in clean energy and sustainability.

- Databricks IPO: Software start-up Databricks is an artificial intelligence (AI) powered data company. It has reached a valuation of $38bn after multiple rounds of financing this year from the likes of Fidelity and Franklin Templeton. Its clients include Royal Dutch Shell and AstraZeneca, with an annual recurring revenue of over $600m.

- Discord IPO: Discord runs an instant messaging platform and app where users can interact over voice, video and text, boasting an audience of over 150 million monthly active users. According to Forbes, the company could be valued up to $17bn, having seen an active year in terms of fundraising.

- Revolut IPO: Revolut is touted as the UK’s biggest fintech company with a valuation of over £24bn and could debut on the stock market at some point in 2022. The company reported a 57% increase in revenue between 2019 and 2020, up from £166m to £261m, of which 15% was accounted for by its cryptocurrency division.

- Klarna IPO: Klarna belongs to the buy now, pay later (BNPL) industry that's taking the financial world by storm, with services allowing users to spread the cost of purchases over multiple transactions. The company has over 90 million active consumers and a valuation of over $45bn, making it one of the most important fintech companies in the world right now. Klarna's IPO could take place at some point in 2022 or 2023.

- Arm IPO: Since its buyout from Nvidia collpased in early 2022, SoftBank subsidiary Arm is expected to go public on its own. The British semiconductor company is reportedly looking towards a IPO in the US at some point this year, and it could be worth up to $75bn, thanks to Nvidia's rising share price.

- Starling Bank IPO: British digital challenger bank Starling has grown its customer base to more than 2.5 million over the years. It even became profitable during the Covid-19 pandemic and the company shows no signs of slowing down as digital banking continues to grow. It's expected to debut on the LSE between 2022 and 2023.

- Porsche IPO: German luxury sports car manufacturer Porsche is in talks to debut on the Frankfurt Stock Exchange towards the end of 2022. It will part ways with current majority shareholders and parent companies Porsche SE and Volkswagen Group, who plan to list around 25% of the stock in total. Its valuation could be around €90bn after witnessing a revenue increase of almost 25% YoY.

Spread bet or trade CFDs on upcoming IPOs

Recent IPOs

- Nubank IPO: Brazilian neo-bank Nubank listed on the New York Stock Exchange in December 2021. The company's shares began trading at over $11 apiece, giving it a valuation of almost $50bn. This is an even larger valuation than its main rival in Brazil, financial services company Itaú Unibanco. Trade on our Nu Holdings share price.

- Rivian IPO: US company Rivian focuses on the manufacturing of electric vehicles and automotive technology. The Amazon-backed business debuted on the Nasdaq exchange on 10 November in the world's largest IPO of 2021, giving it a valuation of over $100bn. The stock jumped more than 30% on its first day of trading. It's now the second most valuable automaker in the US after Tesla, above Ford and General Motors. Trade on our Rivian share price.

- Volvo IPO: Swedish luxury car manufacturer Volvo Cars is owned by parent company Geely, who raised over $2.3bn in one of the biggest listings in Europe of 2021. It has listed on the Nasdaq Stockholm stock exchange and shares jumped as much as 22% on its opening day. The automotive company plans to shift its entire car range to fully-electric models by 2030. Trade on our Volvo share price.

- Robinhood IPO: US stock and options trading app Robinhood has grown its user base by a third this year and it is valued at around $35bn. Robinhood debuted on the NASDAQ exchange, a popular choice for technology companies, at the lower end of its share offering of $38 apiece. Trade on our Robinhood share price.

- Wise IPO: One of the most eagerly awaited fintech IPOs, the online payments service Wise (formerly known as TransferWise) offered its shares to the public on 7 July 2021 on the London Stock Exchange. The British company has experienced rapid international growth over the past couple of years. Wise shares opened at 800p and were up 10% by the end of its debut trading day, giving it a valuation of over £8bn. Trade on our Wise share price.

- Didi IPO: Chinese ride-hailing company had its IPO on 30 June 2021, raising $4.4bn in the process. It was the largest US listing of a Chinese company since Alibaba in 2014. The company sold over 316m shares at $14 apiece, giving it an overall valuation of approximately $70bn. Trade on our Didi share price.

How to trade IPO stock

- Research the market. Some currently private businesses have potential to become rivals within the technology, energy, finance, e-commerce, and healthcare industries.

- Buy pre-IPO stock through a participating broker. A number of trading platforms allow you to invest in the company before its future IPO is carried out.

- If this is not an option, you can trade on the company once it is public. This is often through financial derivatives, such as spread bets or CFDs with the option to trade with leverage.

- Pick a strategy. Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

- Keep up to date with news and analysis. This can include daily reports and predictions from professional market analysts and external news providers, such as Reuters and Morningstar.

To spread bet or trade CFDs on the price movements of an upcoming IPO after it has passed the process, it's a simple process to register for a live account with us and get started now.

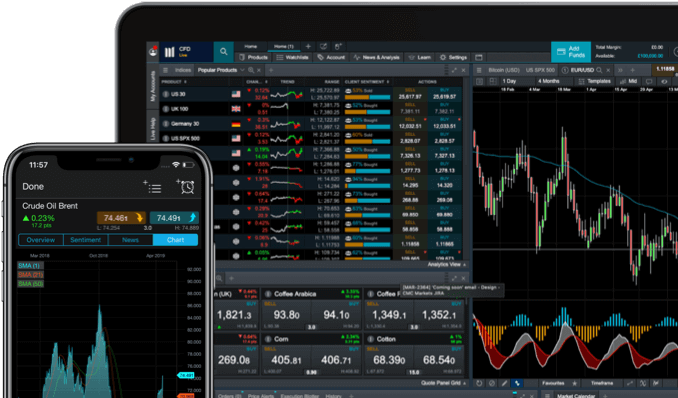

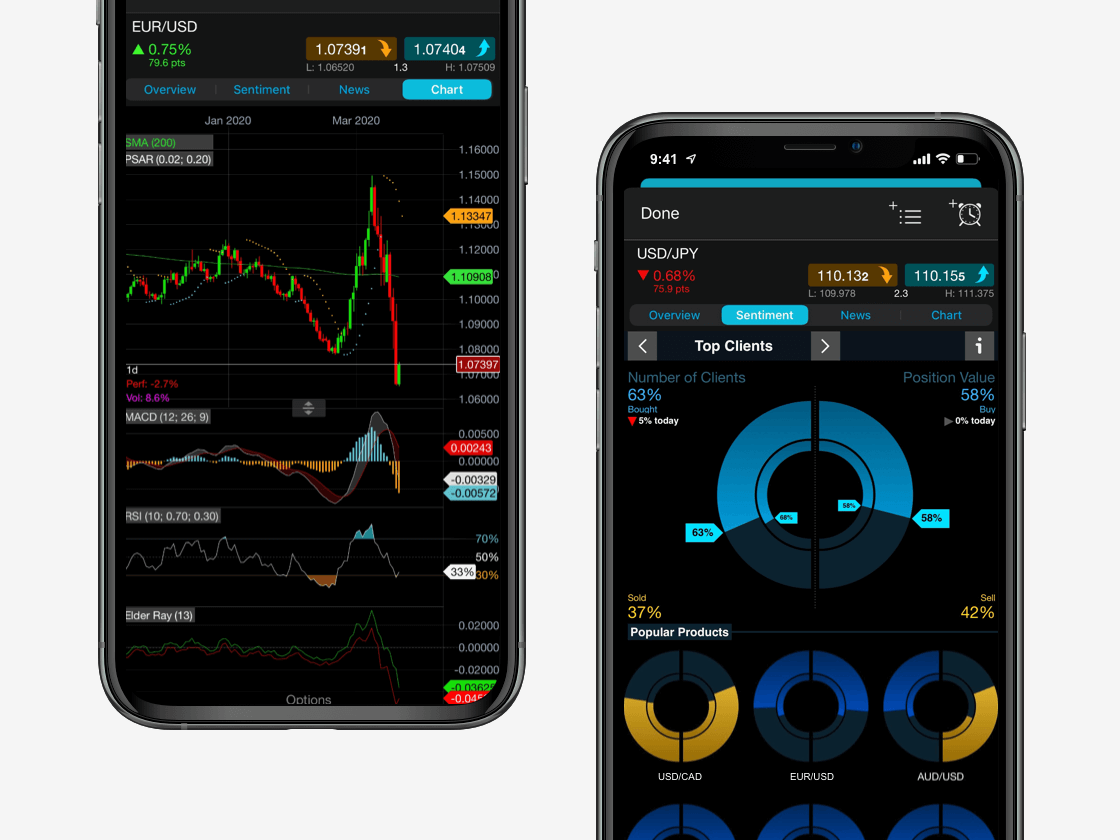

Powerful stock trading platform

Seamlessly open and close trades, track your progress and set up alerts

FAQ

Are IPOs a good investment?

IPOs offer a good way to get involved in newly-listed shares of a company that has been private, especially if the company fundamentals are promising. However, there is no guarantee of future success. Learn more about conducting company analysis.

Can I short IPO stock on the first day?

Some trading restrictions usually apply after an IPO has gone live, so you may not be able to short the stock on its first day of trading. This will usually last for a few days. Learn how to short a stock.

What’s the difference between a traditional IPO and a SPAC IPO?

The main differences between traditional initial public offerings (IPOs) and special purpose acquisition companies (SPACs) lie in their pricing and the length of the process. SPACs usually work on a shorter timeline and have smaller underwriting fees. Read more about SPACs.

Who sets the price of an IPO?

Investment banks and underwriters usually set the IPO price. Usually, the company will decide how many shares it wants to make available to the public, and then the nominated bookrunner will conduct a valuation of the company.

Can you lose money trading on IPO stock?

You can lose money when trading on newly-listed IPO stock if the company underperforms and either opens or closes at a lower price than expected. You should therefore consider using risk-management controls, such as stop-loss orders, to manage your risk.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.