Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Reddit IPO

Everything you need to know

US social media aggregation and discussion site Reddit has reportedly filed for an IPO to take the company public on the New York Stock Exchange at some point in early 2022. Learn how to get notified for Reddit’s IPO and discover company financials, potential valuation, and share price.

Early 2022

Reddit going public

$15bn

Reddit’s valuation

$100m

Reddit’s 2020 revenue

A brief overview of the company

Reddit is essentially a collection of online forums where users can discuss endless topics, including finance and business, pop culture, news, sports, and video games. The site has 52 million daily active users across the world who post, vote, subscribe, and comment on each other’s threads. Reddit offers over 100,000 communities in total.

One of the company’s best-known “subreddits” is the forum for /wallstreetbets, which rose to prominence in January 2021 for its involvement in the stock market, a trend that has continued throughout the rest of the year. A collection of retail traders joined together to drive rallies in the shares of struggling companies such as GameStop, AMC Entertainment, and BlackBerry, to name a few. This led to soaring share prices and short squeezes in certain stocks, causing panic among institutional investors and hedge funds, who lost a significant amount of money as a result of the forum. Since then, similar types of “meme stocks” have been targeted and Reddit has become a popular source of discussion for trading in the stock market.

When is Reddit’s IPO date?

Reddit haven’t released an IPO date yet, and we’re still waiting on an official S-1 filing with the Securities and Exchange Commission (SEC). It is expected to go public within the next year, most likely the first quarter of 2022, on the NYSE.

Stay up to date with upcoming IPOs and new stocks by registering for our IPO mailing list below. We’ll send you notifications by email when Reddit (along with other stocks of interest) have debuted on their chosen exchange.

What will Reddit’s share price be?

An official share price hasn’t yet been revealed either as we can expect this closer to the IPO date. Check back here for more information when Reddit exposes further details.

What about Reddit’s valuation?

According to Reuters, Reddit is seeking a valuation of around $15bn.

The company’s valuation was previously estimated at $10bn in a fundraising round that took place in August 2021, led by Fidelity Investments. The company has raised almost $1bn in funding so far from multiple investors, which include private equity and venture capital firms such as Sequoia Capital, Tencent, and Andreessen Horowitz, as reported by The Guardian.

In comparison, Reddit’s $10bn valuation next to Snap’s $90bn or Pinterest’s $30bn market cap may seem small. However, Reddit has a much more unique product offering to which it has stayed true since the company was founded in 2005, without acquiring or merging with other companies; therefore, it is expected that Reddit could have a smaller market value.

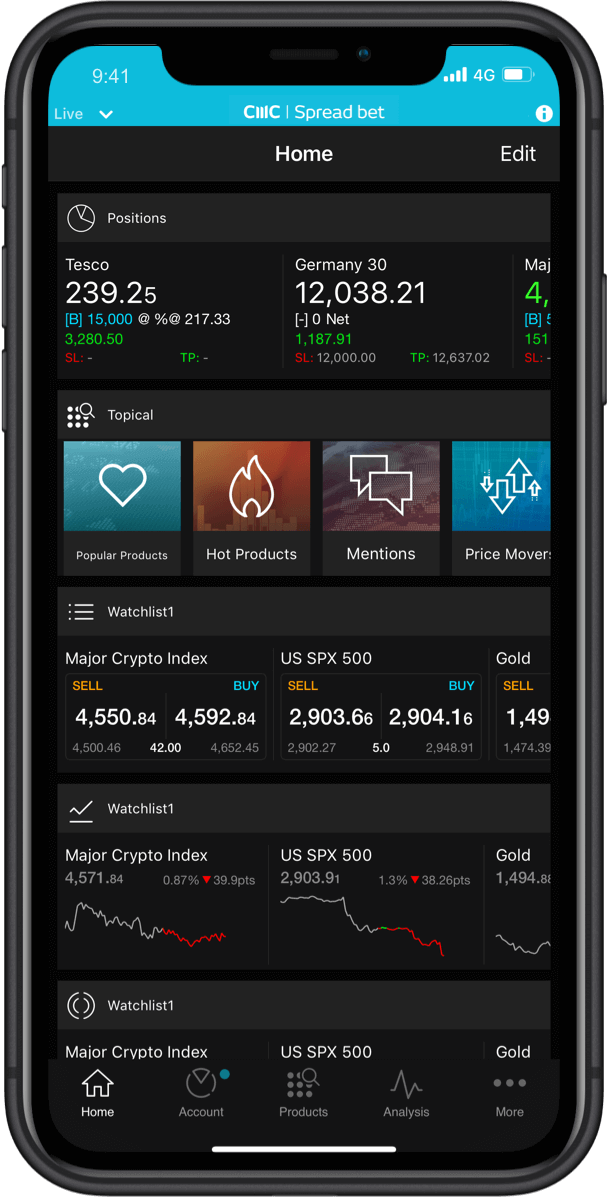

How to spread bet or trade CFDs on Reddit’s IPO

1. Register your interest

By entering your email into the sign-up box above, we will notify you when Reddit has listed on its chosen exchange, along with other IPOs that may be of interest.

2. Open an account

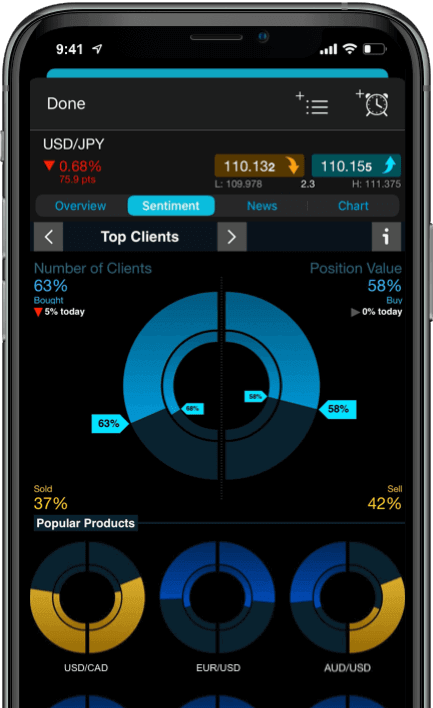

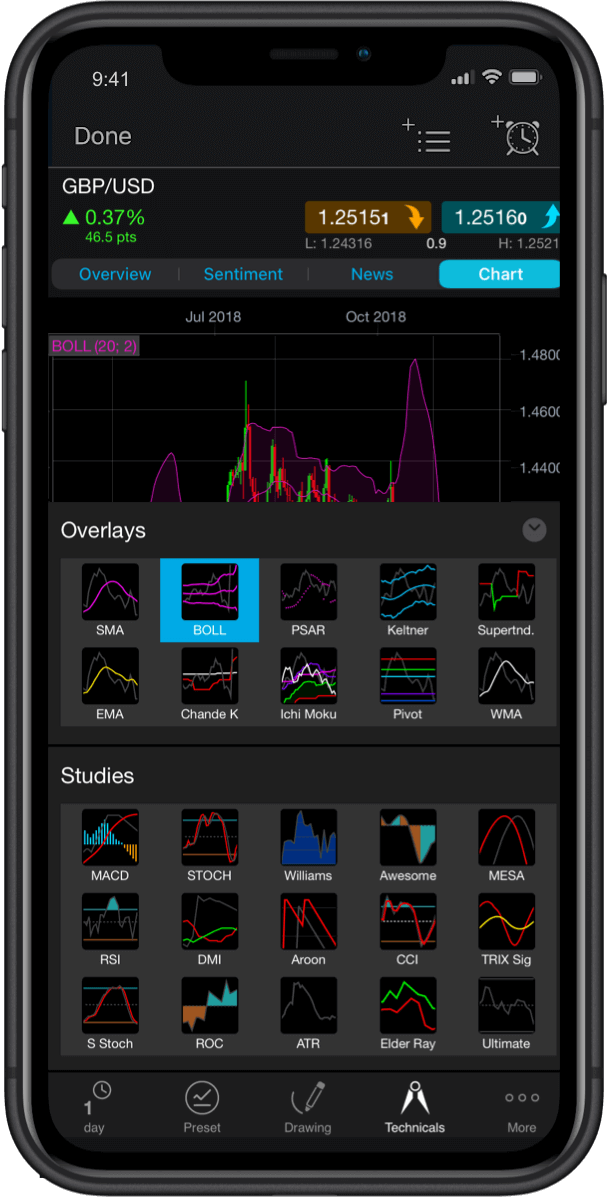

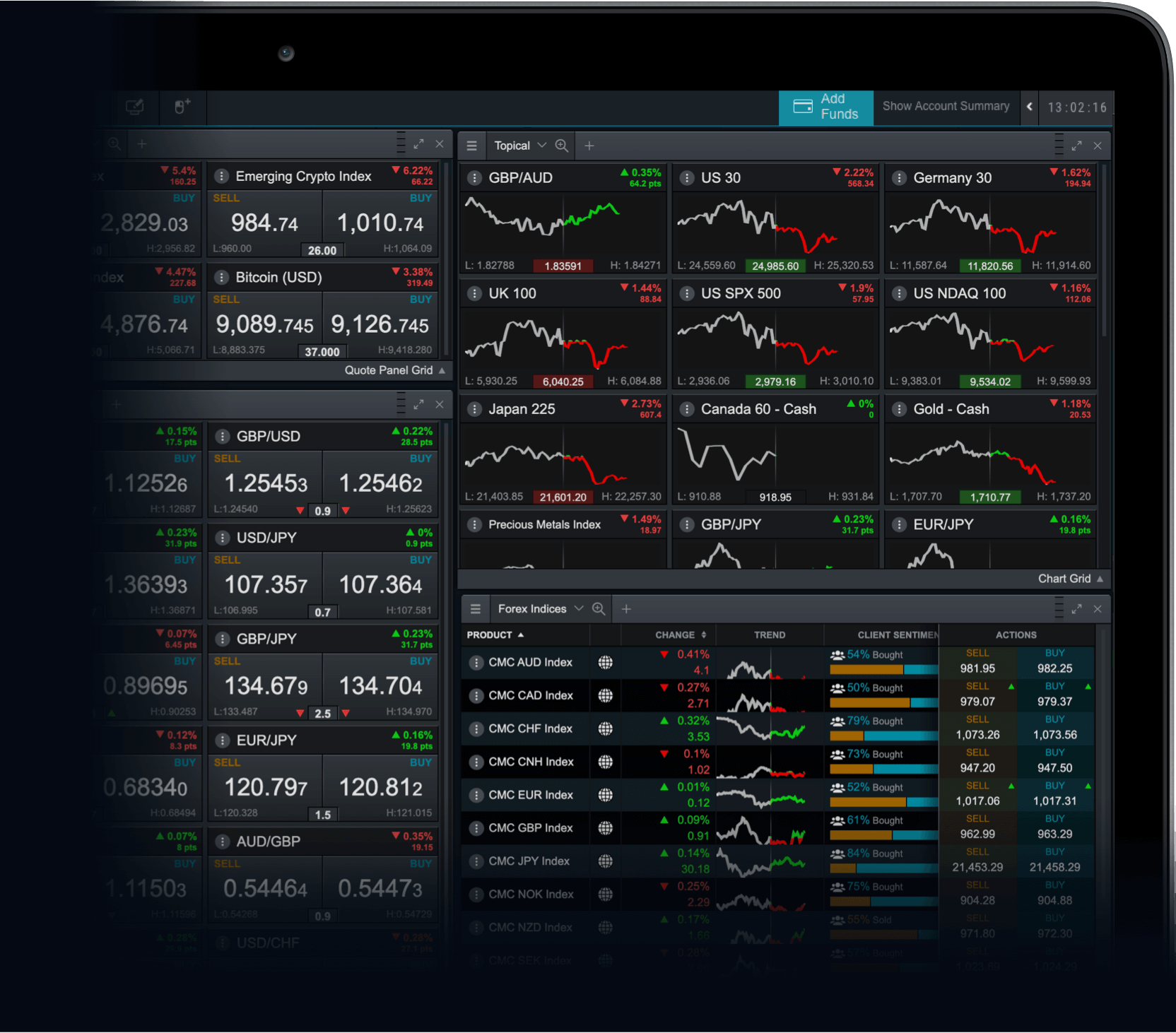

Choose whether you want to spread bet or trade CFDs when the derivative is available on our platform. You can practise trading on Reddit’s competitors in the meantime with virtual funds on a CMC Markets demo account.

3. Pick a strategy

Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

4. Manage your risk

Learn how to apply stop-loss and take-profit orders to reduce the risks that come with trading in the IPO market.

Reddit’s financials: an insight

Reddit makes most of its revenue through third-party advertising on the website. In the second quarter of 2021, the company reported advertising revenues of more than $100m for the first time, which is a 192% increase versus Q2 2020.

According to Public.com, in 2020, Reddit made $170m in revenue (primarily from advertising), so the company could be on track to overtake this figure by the end of the year.

However, given that it’s a private company and an S-1 filing hasn’t yet been made, there is little other public information known about Reddit’s financials. Look out for when Reddit files an official report with the SEC for more in-depth details about profits and net losses over 2021.

Please remember that past performance isn’t indicative of future results.

Why may investors be interested in Reddit’s IPO?

Why may investors steer clear from a Reddit IPO?

Discover Reddit’s competitors

Snap

- All clients

97% of CMC client accounts with open positions on Snap expect the price to rise.

Pinterest

- All clients

97% of CMC client accounts with open positions on Pinterest expect the price to rise.

Meta Platforms

- All clients

97% of CMC client accounts with open positions on Meta expect the price to rise.

Twitter

- All clients

96% of CMC client accounts with open positions on Twitter expect the price to rise.

Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice – it must not form the basis of your trading or investment decisions.

FAQS

What are some other IPOs going live in 2021?

Although Reddit’s IPO is planned for early 2022, there are still opportunities within the stock market for the remaining months of this year, including Monzo, Stripe, Databricks, and Polestar. Browse our page for upcoming IPOs in 2021.

Who are Reddit’s biggest investors?

According to Reuters, some of Reddit’s biggest investors include Fidelity, Sequoia Capital, Andreessen Horowitz, and Chinese tech giant Tencent Holdings.