Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Arm IPO

Everything you need to know

British semiconductor company and SoftBank subsidiary Arm Holdings is speculated to be considering an initial public offering within the next year after its buyout deal from Nvidia collapsed. Learn more about the company and how to get involved with its upcoming IPO.

Sometime in 2022

Going public

$40bn+ (£29.6bn)

Valuation

$2.5bn

2022 revenue

What does the company do?

Arm Holdings, which was founded in 1990 with headquarters in Cambridge, is a semiconductor and software designer. The company’s name stands for Advanced RISC Machines, which is a family of reduced instruction set computer (RISC) architectures that utilise central processing units (CPUs), system on a chip (SoC), and system on module (SoM) designs.

It has a significant market share for these processors and chips, which are used in mobile phones, tablets, smart TVs, laptops, although the company doesn’t manufacture them themselves, but rather licenses the designs to other companies. Since its inception, Arm has shipped over 200 billion chips around the world, and close to 900 chips based on its architecture are produced every second.

Some well-known products that it has helped to materialise include the Nokia 8110 and 6110, BBC microcomputer, Ford’s smart car, Amazon Kindle e-reader, Da-Jiang Innovations (DJI)’s drones, and Fitbit’s smart watches.

When is Arm’s IPO date?

The company doesn’t yet have an IPO date in place, but its CEO has said that it could take place as early as 2022, before the end of the financial year 2022-23. By entering your email into the sign-up box below, we’ll notify you when Arm stock has listed on its chosen exchange.

Where will it be listing?

Although it’s a British company, SoftBank is reportedly eyeing up an IPO in the US (most likely on the tech-focused Nasdaq exchange), according to the Financial Times, as there are concerns that the stock would be undervalued in the London market.

This has caused some outrage in the UK, similar to when Japanese tech conglomerate SoftBank took over the company in 2016. The country has faced scrutiny over recent years for its inability to retain British technology companies and the IPO market has experienced several flops (most notably Deliveroo in 2021).

What will Arm’s share price be?

A share price hasn’t yet been revealed, as this information is usually disclosed nearer to the IPO date. Keep an eye out for news and updates relating to this if you want to stay in the loop.

What is Arm’s valuation?

Arm is reportedly worth over $40bn (£29.6bn) according to a proposed takeover bid by Nvidia in 2020. The company was due to be bought out by the semiconductor giant, but these plans failed to materialise and were officially cancelled in 2022, due to strong opposition from regulators and competitors across the US, UK, and Europe.

As Nvidia’s share price has soared over the past two years since the company announced its takeover, Arm could be worth up to $75bn when it actually goes public, according to The Guardian.

How to trade on the IPO

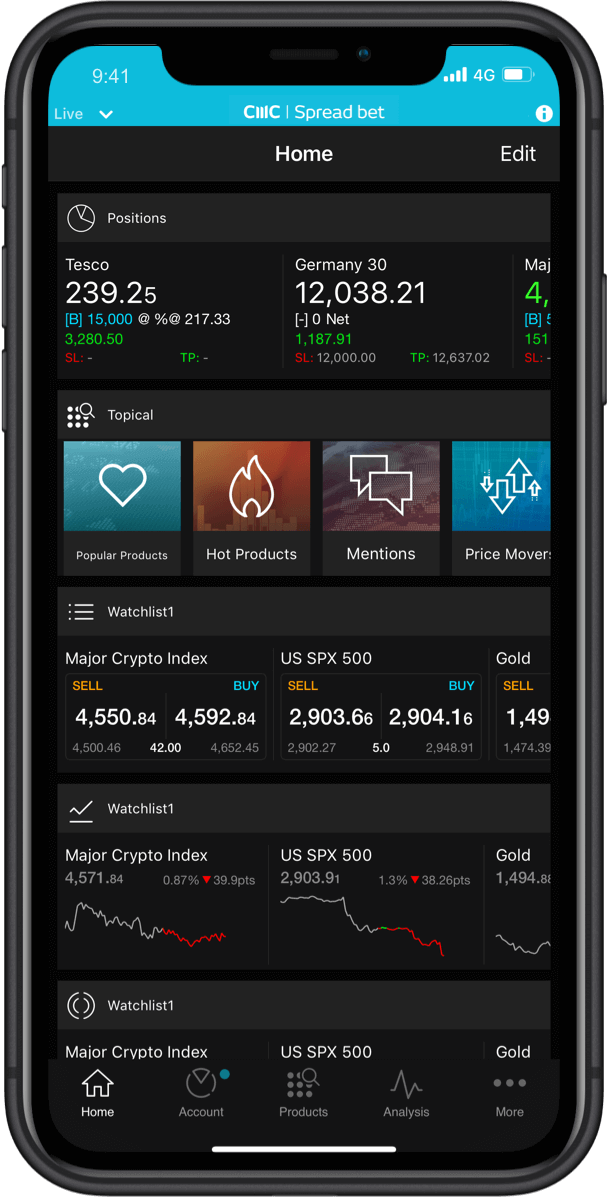

1. Open an account

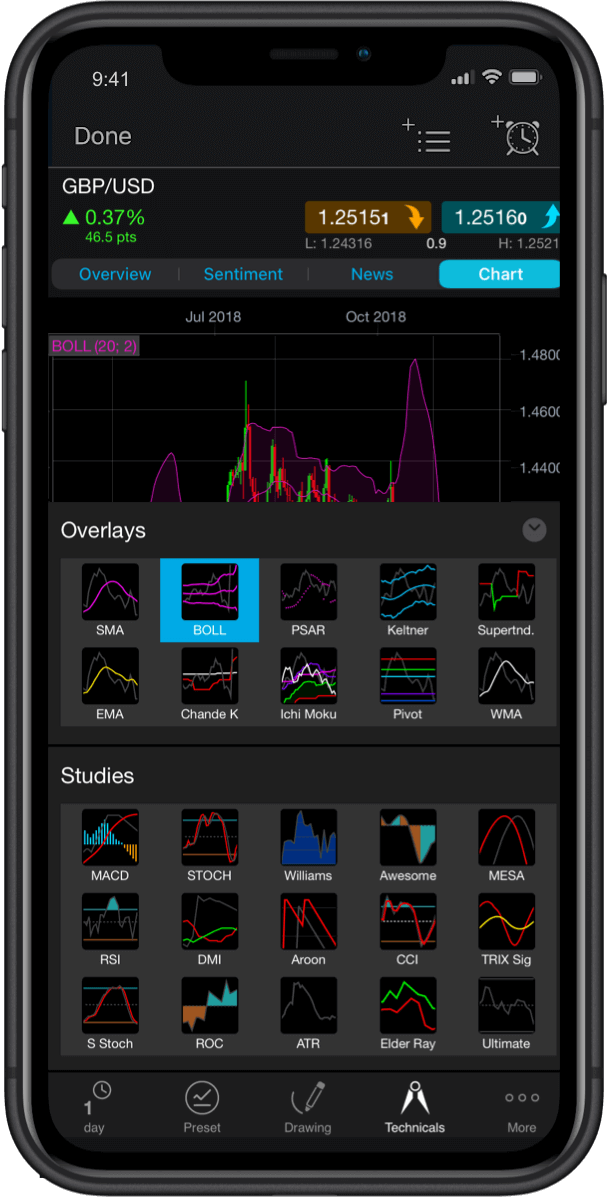

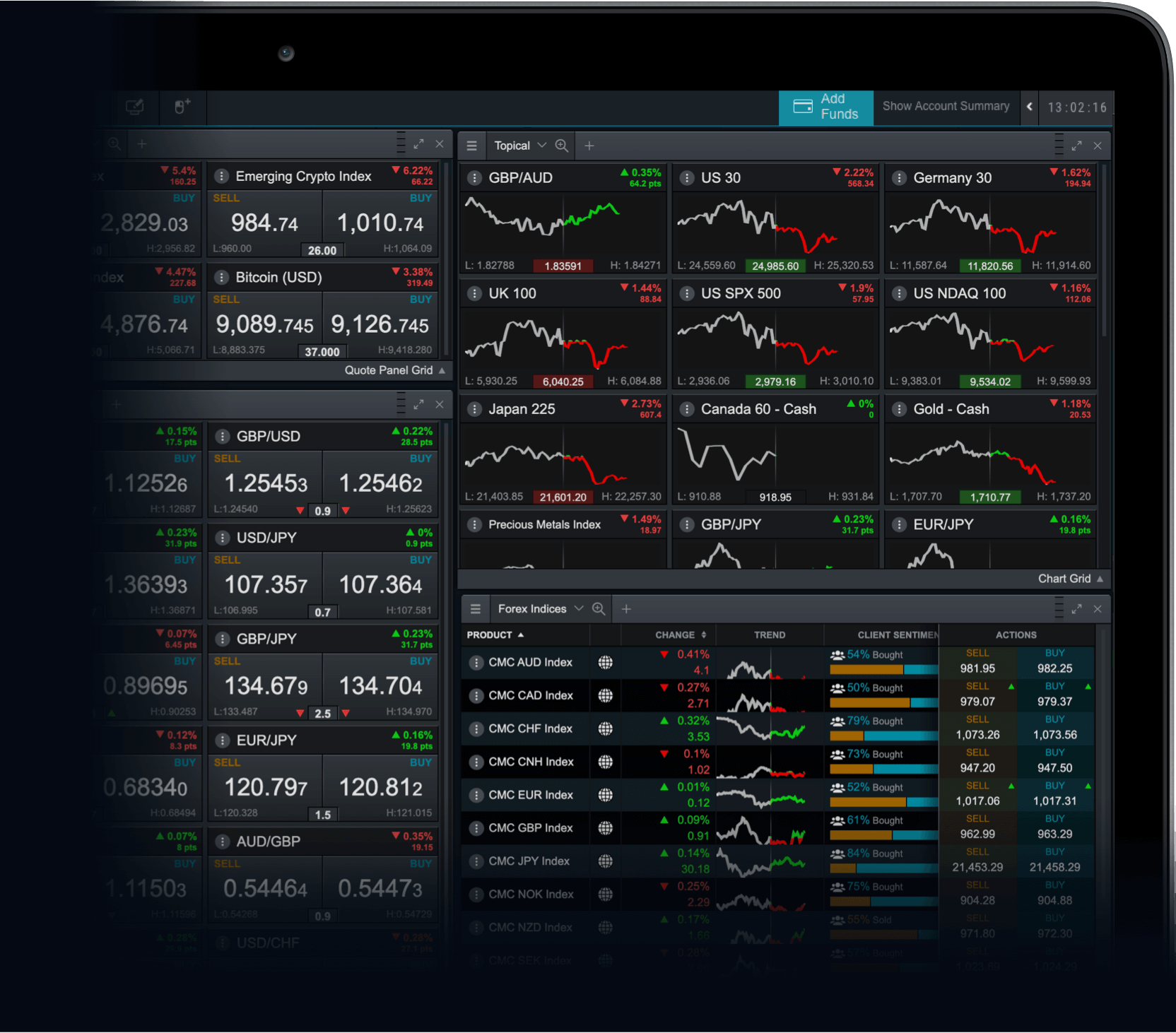

Choose whether you want to spread bet or trade CFDs when the derivative is available on our platform. You can practise trading on Arm’s competitors in the meantime with virtual funds on a CMC Markets demo account.

2. Register your interest

By entering your email into the sign-up box above, we will notify you when the company has listed on its chosen exchange.

3. Pick a strategy

Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

4. Manage your risk

Learn how to apply stop-loss and take-profit orders on your positions to minimise capital loss as much as possible.

What do the company’s financials look like?

Before its acquisition in 2016, the company was listed on the London Stock Exchange and part of the FTSE 100 index. Since then, Arm’s financials have shown slow but steady growth, as reported in SoftBank’s annual subsidiary reports.

For the financial year ending March 2022, Arm is forecasted to have generated around $2.5bn in revenue and $900m in adjusted EBITDA, which is a record high for the company, according to Forbes. This is in comparison with the previous year’s $1.98bn and 2019’s $1.81bn, showing a sudden jump which could be attributed to the worldwide chip shortage. While many may assume that the company isn’t profitable because it was acquired by SoftBank, this isn’t quite the case, and Arm’s financial reports prove this.

Previous CEO Simon Segars was also replaced by Rene Haas in February 2022, helping to shake up the company even more.

Please note that past performance is not a reliable indicator of future results.

Why may investors be interested in the IPO?

Is Arm facing any challenges?

Explore some competitor stocks

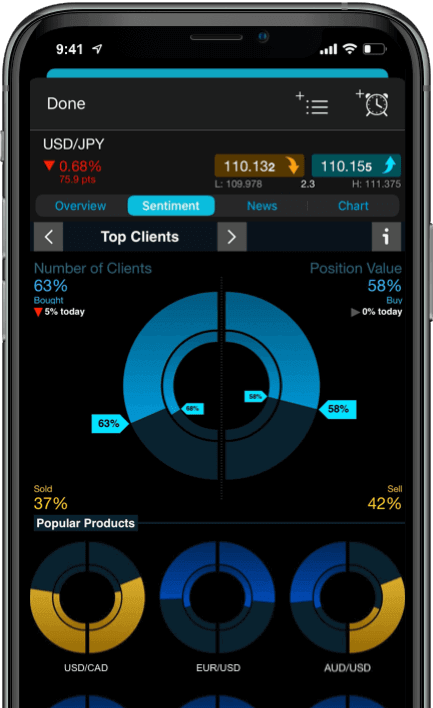

Nvidia

- All clients

95% of CMC client accounts with open positions on Nvidia expect the price to rise.

Advanced Micro Devices

- All clients

98% of CMC client accounts with open positions on AMD expect the price to rise.

Qualcomm

- All clients

96% of CMC client accounts with open positions on Qualcomm expect the price to rise.

Intel

- All clients

88% of CMC client accounts with open positions on Intel expect the price to rise.

Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice – it must not form the basis of your trading or investment decisions.

FAQS

What are some other semiconductor stocks to watch?

Some of Arm’s competitors within the semiconductor industry include Qualcomm, IBM, Advanced Micro Devices, and Skyworks Solutions, which are all involved in the design or manufacturing of CPUs, chips, and other related components.

Is Arm a UK tech company?

Arm is a Cambridge-based designer of semiconductor chips, software, and related tools, making it a potentially exciting company to watch in the future. See more UK tech stocks to watch right now.