Starlink IPO

How to trade on Starlink shares

Elon Musk’s satellite communications business Starlink is speculated to be eyeing an initial public offering, which could happen at any time within the next couple of years. Find out everything you need to know about the SpaceX spin-off, Starlink’s potential IPO and how you can get involved with Starlink shares.

2022/2023

Starlink's IPO date

$42bn+

Starlink's valuation

$30bn

Starlink's annual revenue

What is Starlink?

Starlink is a satellite constellation that provides internet access to most of the Earth, ran by Elon Musk’s aerospace company SpaceX. It is a network of more than 1,000 satellites that deliver high-speed service anywhere on the planet. Starlink has secured regulatory approval in the UK, Australia, Greece and Germany so far, and has over 10,000 users globally. Its first full year of service is expected to be in 2021.

When is Starlink’s IPO date?

Starlink hasn’t yet released an official date, saying only that it will have an IPO “when its cash flow is more predictable”. CEO Elon Musk first announced plans for an IPO in February 2020, but this could take several years, depending on the health of the space sector.

Sign up below to receive notifications on Starlink’s IPO closer to the time and browse our upcoming IPOs page for more companies to watch in the meantime.

What is Starlink’s valuation?

There is a lot of speculation around Starlink’s valuation, and most analysts agree that Starlink makes up the majority of its parent company’s value. Analyst Adam Jonas from Morgan Stanley predicts that out of SpaceX’s overall valuation of $74bn, Starlink accounts for around $42bn or even higher.

In a written report in September 2020, Morgan Stanley predicted that Starlink could even reach a valuation of $81bn before it goes public. This is due to growth within the space sector and recent achievements from both companies, such as bringing back NASA astronauts from space, launching more satellites and conducting test flights of its Starship rocket. However, past performance is not indicative of future results.

SpaceX’s latest funding round took place in April 2021, raising a total of $1.6bn in the first half of 2021.

How to trade on Starlink’s IPO

1. Register

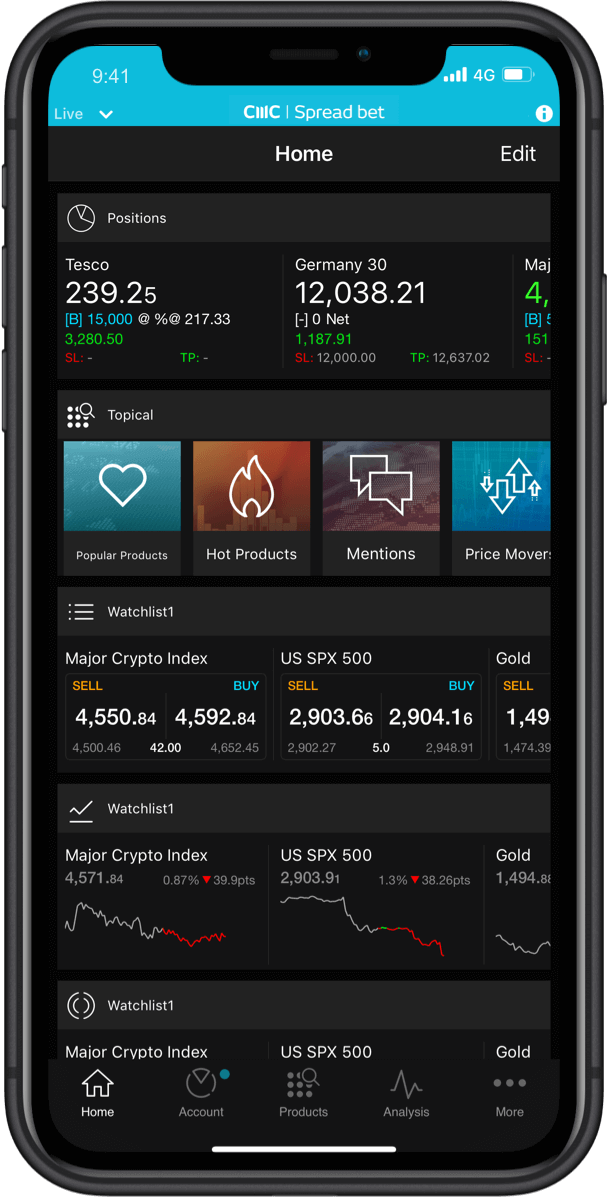

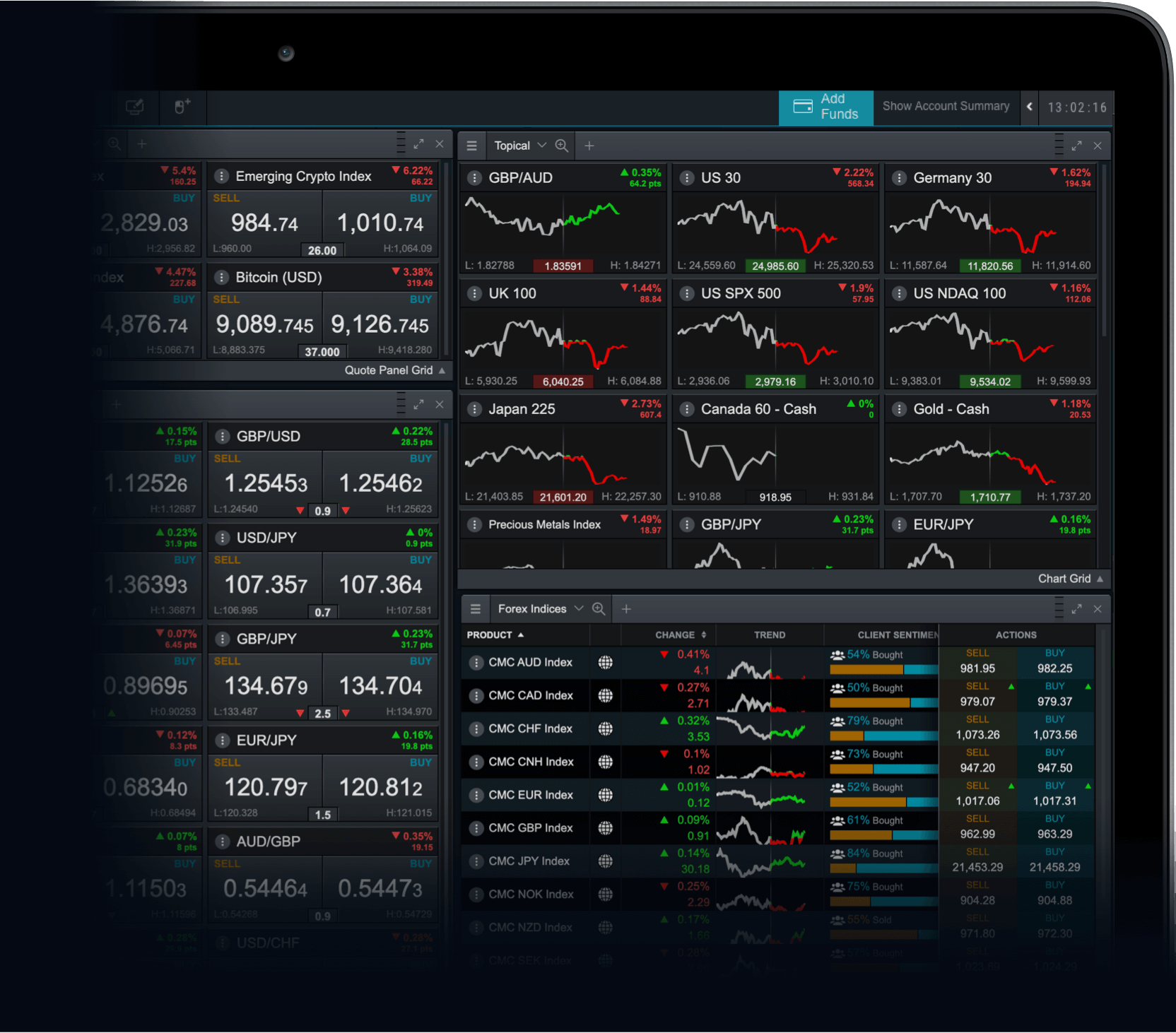

Decide whether you want to spread bet tax-free* or trade CFDs on Starlink’s upcoming listing.

2. Pick a trading strategy

Decide whether to buy (go long) if you think Starlink will increase in value or sell (go short) if you think it will decrease.

3. Read our risk-management guide

Find out how to combat stock market risk by placing stop-loss and take-profit orders on open positions.

4. Practise while you wait

Trade on competitor stocks such as Virgin Galactic, ViaSat and Boeing to solidify your knowledge of the space market.

An overview of Starlink’s financials

Starlink’s satellite constellation program costs around $10bn but is expected to bring in annual revenues of between $30bn and $50bn. This may be reflective of a sector that is seeing a large influx in investment, as throughout the first quarter of 2021, Space Capital reported that almost $1.9bn was invested in space companies. Therefore, Starlink’s future IPO may garner a large amount of market interest.

The company has launched over 1,000 satellites for Starlink and intends to have a total of 42,000 satellites once the project is complete. Forbes even estimates that Starlink will garner about 2.3% of all new internet users by 2025, with coverage spanning a large portion of the global population. As Forbes’ valuation of Starlink is slightly lower than that of Morgan Stanley, at $30bn, this could mean that Starlink will be generating revenues of over $10bn per year.

However, there is no way to tell without official company reports, so we will have to wait until closer to the IPO date for Starlink’s financials to be released in more detail.

Why may investors be interested in Starlink?

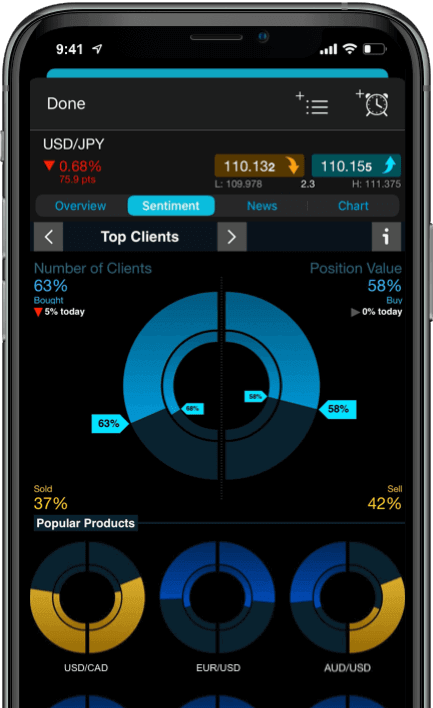

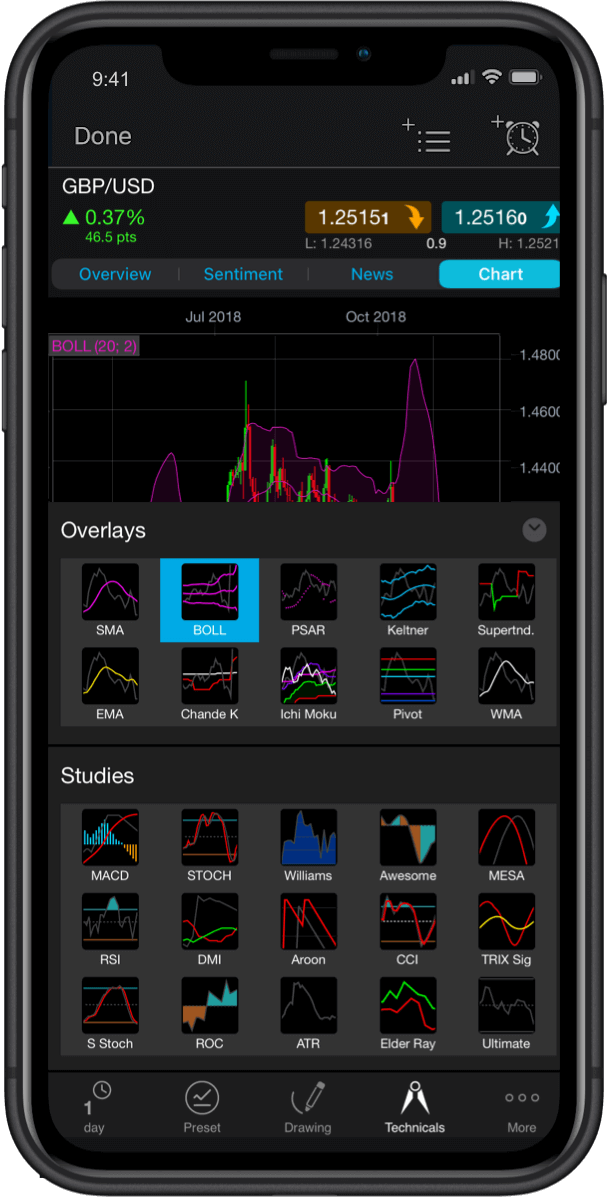

Trade on upcoming IPOs with us

What are some potential challenges for Starlink?

Who are Starlink/SpaceX’s competitors?

The space field is very competitive right now so there is a lot of pressure for both Starlink and its parent company to perform. In particular, the low earth orbit (LEO) satellite industry is quite niche, so the companies that would pose the most threat to Starlink perhaps would be ViaSat [VSAT], Boeing [BA], Orbcomm [ORBC], Globalstar [GSAT], Iridium [IRDM] and EchoStar [SATS]. These stocks are all available to trade on, on our Next Generation trading platform with a spread betting or CFD trading account while you wait for Starlink’s listing to become live.

In comparison with Starlink, the majority of the above companies seem to have much smaller valuations of around $2-6bn. This could suggest that although Starlink will arrive later to the stock market, it may gain a larger market share straight away and perform well in the face of its competitors.

Starlink may also face competition from billionaire-backed businesses such as Kuiper, a subsidiary of Amazon, which has been approved to deploy over 3,200 satellites as part of an initiative to build a LEO constellation, according to the company’s website. Another potential is Microsoft’s Azure Orbital, which is a fully managed Ground Station as a service introduced to the public in 2020. As the space sector is expanding so quickly, investors should keep an eye out for news and developments.

Read our complete guide to space stocks and ETFs to watch right now.

No.1 Web-based Platform

ForexBrokers.com

Best Spread Betting Provider

The City of London Wealth Management Awards

Best CFD Provider of the Year

Shares Awards

FAQ

How can I trade on Starlink?

To start trading on Starlink shares after the IPO, open an account, where you will be able to choose between spread betting and CFDs. You can then explore the platform and trade on competitor stocks while you wait for Starlink to become available.

Who will decide the price of Starlink’s IPO?

IPO prices are usually set by the underwriters, who also perform due diligence and help to stabilise the market after the stock has been issued. IPOs in the US often involve some of the largest financial companies as their underwriters, such as investment banks like Goldman Sachs and JPMorgan Chase.

How can I sign up for trading alerts for Starlink’s IPO?

To receive a notification on when Starlink is due to go public, register your email address at the top of this article. Otherwise, you can enable trading alerts for your account, where we will send you updates on breaking news and fresh stocks on our platform.

Will SpaceX ever have an IPO?

Although CEO Elon Musk plans to take Starlink public at some point in the future, there are currently no similar plans for its parent company, SpaceX. The company claims that they will not IPO SpaceX until they are conducting regular flights to Mars, which is not likely to happen until 2024, according to SpaceX’s website.