Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Porsche IPO

Everything you need to know

German sports car manufacturer Porsche is reportedly in talks to debut on the stock market at some point in 2022. Discover some key points you need to know about its IPO date, valuation, and recent company financials before getting involved with the initial public offering.

End of 2022

Going public

€90bn+

Valuation

24.5% YoY

2021 revenue increase

Overview of the company and its structure

Porsche AG is a German automotive company specialising in high-performance sport cars, as well as SUVs and sedans. It’s controlled by parent company Volkswagen Group, which is the largest automaker in Europe in terms of sales and the second largest worldwide. In turn, VW is owned by holding company Porsche SE, which has a 31.4% stake in the company and also claims more than 50% of its voting rights distribution.

Among the automotive’s famous line-up are the 718, 999, Taycan, Panamera, Macan, and Cayenne models. The business was founded in 1931 with headquarters in Stuttgart. It’s primarily a car manufacturer but also provides financial, engineering, and design services, as well as investment management.

When is Porsche’s IPO date?

The IPO is expected to happen in the fourth quarter of 2022, according to Bloomberg.

Volkswagen has already chosen its underwriters for the IPO, which include financial giants Goldman Sachs, Citigroup, JPMorgan Chase, and Bank of America. Given that Porsche is a valuable German company, it’s likely that it will debut on the Frankfurt Stock Exchange.

Sign up below to receive an email when the company debuts on its chosen stock market, along with other IPOs that may be of interest.

What will Porsche’s share price be?

It’s too early to confirm a share price for the business, although this will be revealed closer to its IPO date. However, Reuters reports that the parent company is expecting to list around 25% of Porsche AG stock in total.

Porsche’s valuation in 2022

The automaker’s valuation has been estimated at around €90bn ($102bn) by various analysts. This is close to Volkswagen’s current market value of around €116bn, and supersedes that of other German automotive giants, such as BMW (€51bn) and Mercedes-Benz (€68bn), which have been listed on the stock market for years.

Upon initial announcement of the IPO, shares in VW and Porsche SE jumped by 10.2% and 15.2%, suggesting that investors may expect Porsche’s brand value to increase in the long term, along with its parent companies.

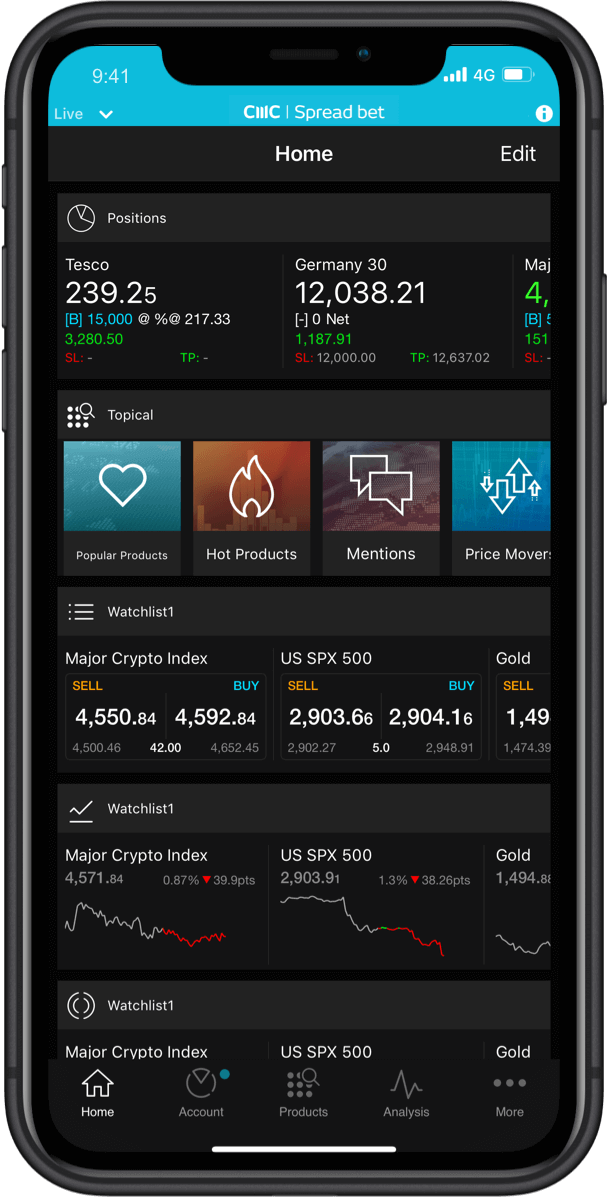

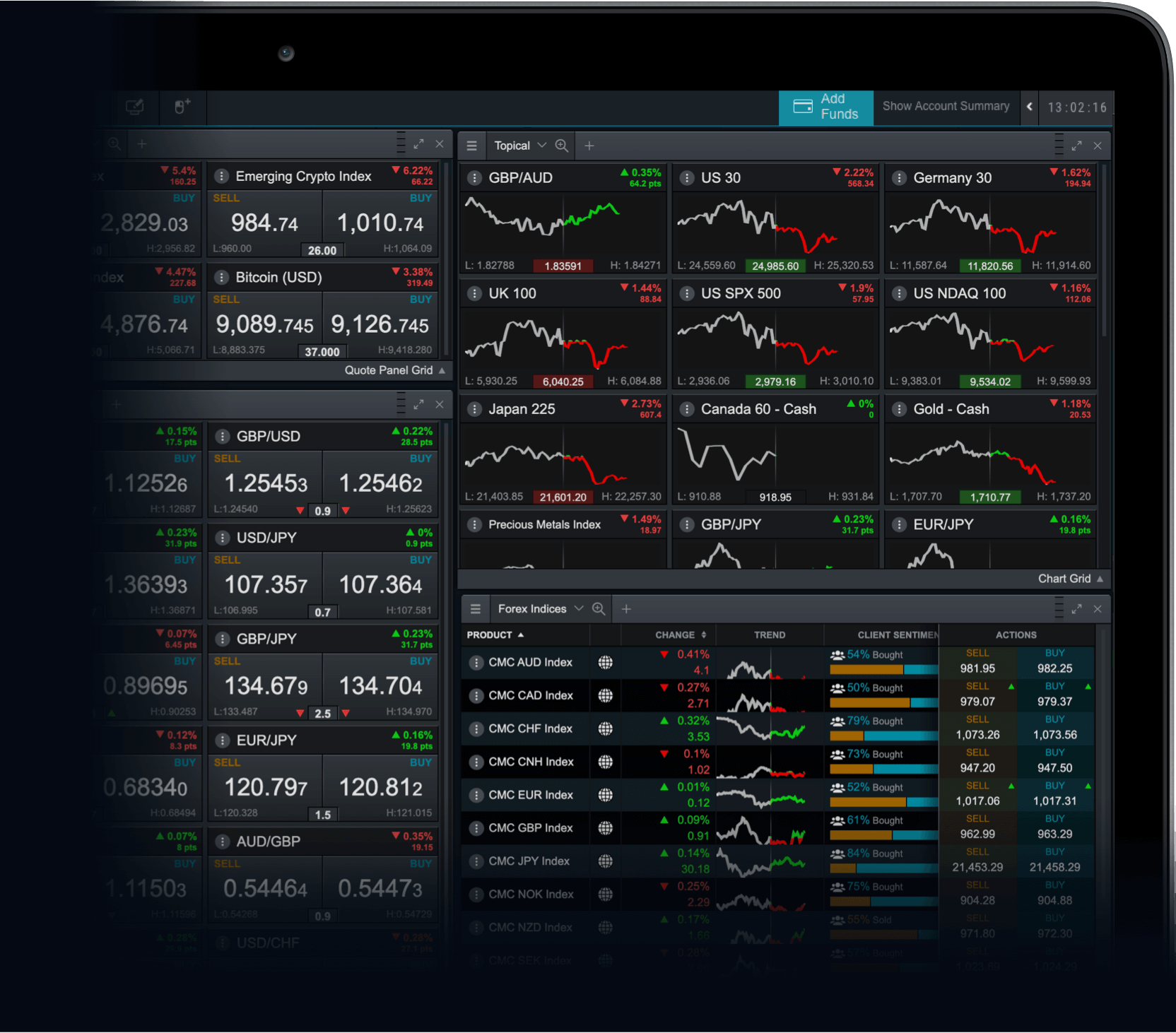

How to trade on the IPO

1. Register your interest

By entering your email into the sign-up box above, we will notify you when the company has listed on its chosen exchange.

2. Open an account

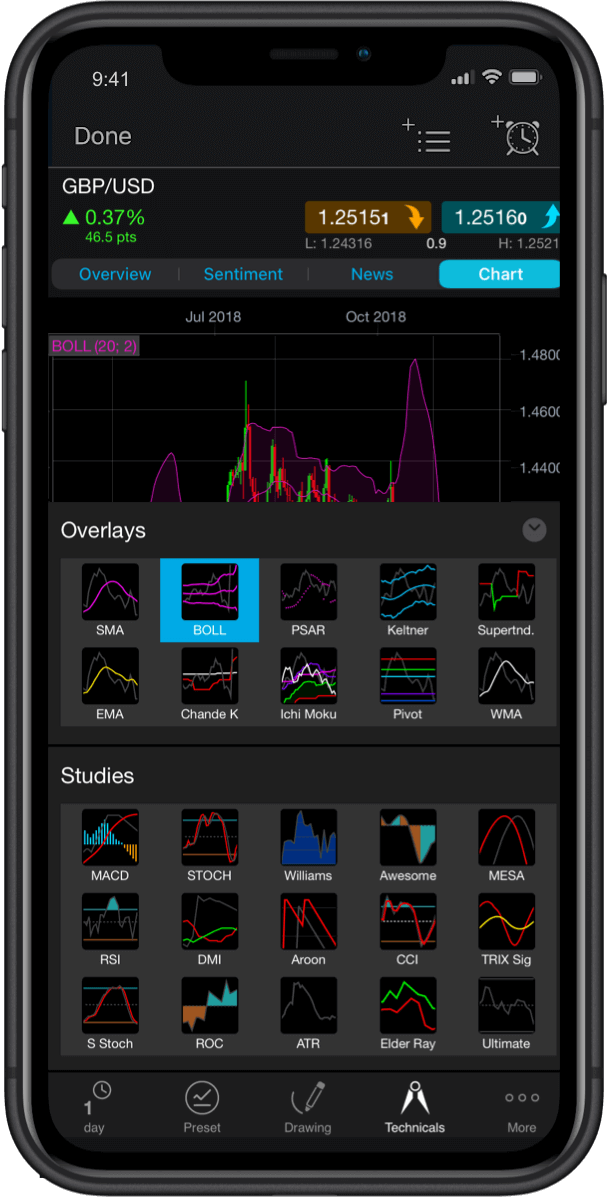

Choose whether you want to spread bet or trade CFDs when the derivative is available on our platform. You can practise trading on the company’s competitors in the meantime with virtual funds.

3. Pick a strategy

Choose whether you want to go long (buy) or go short (sell). Please note that some trading restrictions may apply on initial trading.

4. Manage your risk

Learn how to apply stop-loss and take-profit orders to reduce the risks that come with trading in the IPO market.

What are Porsche’s financials like?

Over the past decade, the company saw a strong increase in revenue, almost tripling from €10.9bn in 2011 to €30.3bn in 2021. It also saw earnings increase by 24.5% when compared with 2020, showing the boom for vehicles after the peak of the Covid-19 pandemic.

In the financial year ending 2021, the business delivered 302,000 sports cars to customers, an increase of 10.9% versus the previous year. China and the US are the largest markets in terms of sales, where increases of 7.5% and 22.2% were witnessed. According to Statista, the company’s Taycan model was met with unexpected demand in North America in 2021, where EV stocks are particularly in high demand.

Please note that past performance is not a reliable indicator of future results.

Why may investors be interested in the IPO?

Why may some choose to avoid it?

Discover some of Porsche’s competitors

Mercedes-Benz

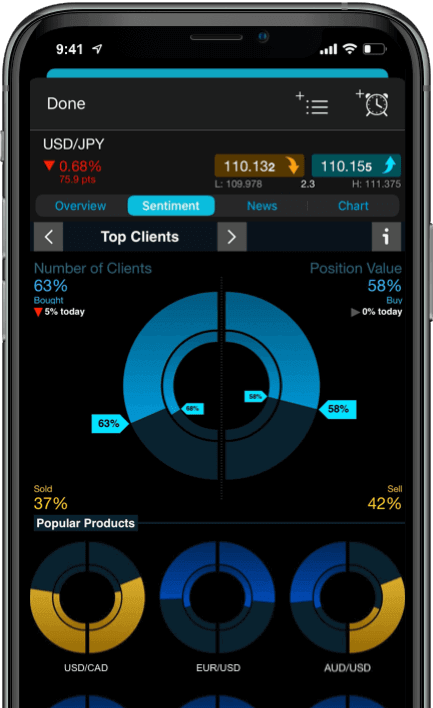

- All clients

81% of CMC client accounts with open positions on Mercedes-Benz expect the price to rise.

Aston Martin

- All clients

88% of CMC client accounts with open positions on Aston Martin expect the price to rise.

BMW

- All clients

82% of CMC client accounts with open positions on BMW expect the price to rise.

General Motors

- All clients

95% of CMC client accounts with open positions on General Motors expect the price to rise.

Client sentiment is provided by CMC Markets for general information only, is historical in nature and is not intended to provide any form of trading or investment advice – it must not form the basis of your trading or investment decisions.

FAQS

Can I trade on Porsche’s parent companies?

You can trade on our derivative share prices for both of Porsche’s shared owners, Volkswagen [VOW] and Porsche SE [ PAH3], using spread bets and CFDs.

Does Porsche have a fully electric car?

The company manufactures both electric and hybrid models. The Taycan line-up is fully electric with a motor range of up to 504km, while Cayenne and Panamera are plug-in hybrid models that have an electric motor with a battery, as well as a combustion engine. Read more about EV stocks.