How to trade on safe haven assets

Instruments that are considered to be ‘safe havens’ are often used by investors in times of economic uncertainty or hardship in order to offset risk on their existing portfolios. This article will explore the types of assets that may appreciate in value during difficult or volatile times, while others are on the decline.

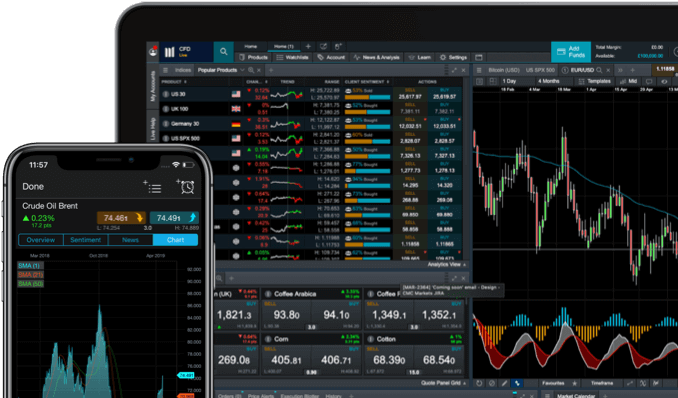

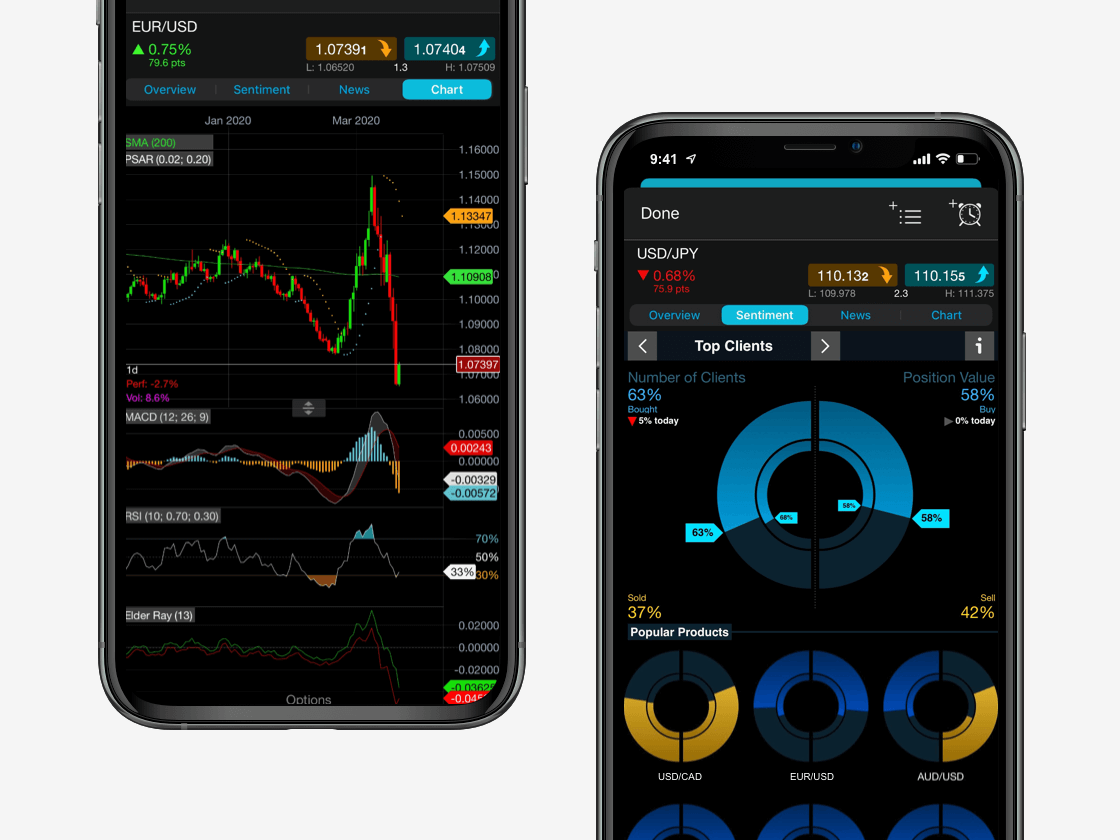

Safe haven assets can include currencies such as the US dollar and Swiss franc, precious metals, defensive stocks and government bonds. These can all be traded on via our Next Generation platform, so why not open a risk-free demo account to practise for potential future situations?

Safe haven meaning in trading

A safe haven typically refers to something that provides security or an escape from things that a person may find worrying or dangerous. This can come in the form of a place, situation or object, but in trading, it comes in the form of an investment. Certain asset classes may provide a feeling of safety.

What is a safe haven investment?

A safe haven investment is an asset that can be used to offset the risk of an investor’s portfolio and limit their exposure to negative shocks. In a market downturn, safe haven investments will often outperform the majority of financial markets.

Safe haven investments often share similar characteristics, such as the following:

- High liquidity

- Stable demand

- Relevance and assurance that it won’t be replaced

- Expected to retain or rise in value during times of economic turmoil

It’s important for traders to recognise assets that are considered of safe haven status for when there is a financial crisis. This way, they can predict the price action of other declining assets and implement the most effective risk-management strategy for the situation, whether this means exiting long positions or opening new short ones. Stock market bubbles, crashes and economic recessions can last for a long period of time, having a negative effect on the value of an investor’s portfolio of assets.

Continue reading to discover some of the most popular safe haven instruments that traders often flock to in times of distress. These are mostly uncorrelated or negatively correlated to the general financial markets.

Safe haven commodities (gold)

The commodity markets offer a number of potential safe haven assets, usually involving precious metals such as gold, but also silver and palladium.

Gold

Gold is perhaps the most commonly perceived safe haven investment. The price of gold has a negative correlation with the stock market, meaning that in a stock market crash, the price of gold will most likely soar. It can also act as a form of insurance, as investors sometimes reallocate assets from their portfolio into the gold market.

Gold trading is a popular strategy for hedging, given that its value has remained constant for many years. In a hedging strategy, traders attempt to balance their potential losses from existing positions by introducing gold into their portfolio.

Other precious metals

Although most investors will immediately think of gold as a safe haven commodity, some are slowly starting to consider other precious metals such as silver and palladium with the same status. In fact, the price of palladium has increased over recent years to become more expensive than gold, which could suggest that this precious metal may share the same safe haven value within the market in the future.

Related instruments

Gold - Cash

- All clients

81%

Long

81% of CMC client accounts with open positions on Gold - Cash expect the price to rise.

Palladium - Cash

- All clients

87%

Long

87% of CMC client accounts with open positions on Palladium - Cash expect the price to rise.

Silver - Cash

- All clients

91%

Long

91% of CMC client accounts with open positions on Silver - Cash expect the price to rise.

Platinum - Cash

- All clients

88%

Long

88% of CMC client accounts with open positions on Platinum - Cash expect the price to rise.

Safe haven currencies (USD, CHF, JPY)

Here is a list of safe haven currencies that investors generally consider to be the strongest, and most resilient and reliable in a financial crisis.

US dollar

Given that the US is the world’s strongest economy, it doesn’t come as a surprise that the US dollar (USD) is a safe haven currency. It typically has a history of stable interest and exchange currency rates. The USD is the world’s global reserve currency; therefore, it’s used for many business deals across the world and isn’t normally negatively impacted by domestic or international uncertainties. Traders may open a long position on currency pairs using USD as the base or quote currency, such as our CMC USD Index, a forex basket composed of pairs with USD as the base.

Swiss franc

The Swiss franc (CHF) is the national currency of Switzerland. This country is known for having a low-volatility capital market, neutral government, tax-friendly policies and low unemployment rates, which traders often choose to make the most of in times of crisis. Switzerland is independent from the European Union (EU), which has helped to make it immune to negative events that occur within the Eurozone, and it is also a popular tax haven for the wealthy to store capital.

Japanese yen

The Japanese yen (JPY) has often been shown to appreciate against the US dollar when there is a period of stock market decline in the US. It is a highly liquid currency and Japan is regarded by many to have a strong and stable economy, increasing investor sentiment towards the Japanese yen. The country has a high trade surplus compared to its debt level, given its exports in telecommunications equipment, electronic machinery and automotive parts. Japan invests a significantly larger amount of money into foreign assets, including those belonging to the US and EU, than vice versa.

Related instruments

EUR/USD

- All clients

58%

Long

58% of CMC client accounts with open positions on EUR/USD expect the price to rise.

USD/CHF

- All clients

62%

Long

62% of CMC client accounts with open positions on USD/CHF expect the price to rise.

USD/JPY

- All clients

61%

Long

61% of CMC client accounts with open positions on USD/JPY expect the price to rise.

CMC USD Index

- All clients

79%

Long

79% of CMC client accounts with open positions on CMC USD Index expect the price to rise.

Safe haven stocks (defensive)

Although the stock market is mainly at the centre of crisis during a market downturn, some specific companies are noted to have outperformed during turmoil, which are referred to as ‘defensive stocks’. This covers major stock market sectors such as utilities, consumer staples and healthcare. Defensive stocks typically have a continual demand for their products or services, even in a period of economic decline or a recession.

For example, companies that provide water, gas, electric or broadband services will always see demand as these are basic necessities for living, along with supermarkets, and general food, beverage and household suppliers. Healthcare providers and pharmaceutical companies have historically performed well during these times, an example being the Covid-19 pandemic and subsequent global recession.

Defensive stocks are the opposite of cyclical stocks, which tend to thrive during economic growth and inflation but fall during periods of hardship.

Related instruments

Pfizer

- All clients

99%

Long

99% of CMC client accounts with open positions on Pfizer expect the price to rise.

Reckitt Benckiser

- All clients

95%

Long

95% of CMC client accounts with open positions on Reckitt Benckiser expect the price to rise.

NextEra Energy

- All clients

94%

Long

94% of CMC client accounts with open positions on NextEra Energy expect the price to rise.

Tesco

- All clients

87%

Long

87% of CMC client accounts with open positions on Tesco expect the price to rise.

Safe haven bonds (gilts, T-bills)

Debt securities are issued by governments across the world and are generally seen to be a stable investment. Gilts in the UK and T-bills or T-notes in the US act as safe haven investments, and this may be based on the credit status of the government and high quality of income for each country.

Given that government bonds provide a fixed rate of return until maturity, after which any principal is then repaid to the investor, this may be a more attractive investment than other safe havens as you’re not losing any of your initial capital. Some even refer to gilts and T-bills or T-notes as “risk-free”. However, these assets are still affected by inflation, interest rates and currency changes. When trading derivative products on any financial market, there is still risk of volatility, combined with the use of leverage, which can lead to large losses if your positions are not protected by adequate risk-management controls.

Related instruments

Uk Gilt - Cash

- All clients

53%

Long

53% of CMC client accounts with open positions on UK Gilt - Cash expect the price to rise.

US T-Bond - Cash

- All clients

53%

Long

53% of CMC client accounts with open positions on US T-Bond - Cash expect the price to rise.

US T-Note 2 YR - Cash

- All clients

57%

Long

57% of CMC client accounts with open positions on US T-Note 2 YR - Cash expect the price to rise.

US T-Note 10 YR - Cash

- All clients

72%

Short

72% of CMC client accounts with open positions on US T-Note 10 YR - Cash expect the price to drop.

How to trade on safe haven assets

- Open a live account. You can deposit funds and start trading the live markets right away.

- Choose your product between spread betting and CFDs. Remember that spread betting is completely tax-free in the UK and Ireland*, whereas CFDs require you to pay capital gains tax and come with commission fees for shares.

- Browse our product library. We offer trading on 12,000+ markets, including the safe haven assets mentioned in this article.

- Pick a strategy. Whether you decide to go long or short, read our guide on hedging strategies to find out how safe haven assets can aid your portfolio during a market downturn.

- Remember to consider risk-management. Using controls such as stop-loss orders can help to close you out of a trade at a specified price that you don’t want to exceed.

Trade on safe havens with virtual funds

Seamlessly open and close trades, track your progress and set up alerts

What are the advantages of safe haven assets?

- They can provide a more stable investment during times of economic turmoil.

- Most safe havens perform consistently well all-year round and the economy is not expected to crash frequently in order for them to survive.

- Having a mixture of safe haven assets in an investment portfolio, as well as other instruments such as growth stocks or crude oil, can help to spread risk.

Are there any disadvantages of safe haven assets?

- As safe havens typically rise in value as the stock markets fall, this may have an adverse effect when the stock markets are rising, meaning that your positions will be less valuable.

- What people consider a safe haven investment can change over time.

- Safe havens aren’t guaranteed to perform in the same way throughout multiple periods of market volatility, so it’s important to remember to diversify your portfolio all-year round.

FAQ

What makes a currency a safe haven?

Safe haven currencies belong to countries that investors perceive as the strongest or least likely to pose risk when there is economic stress, examples being the US, Japan and Switzerland. However, not all currencies are considered safe havens just because they are strong in value; see our guide to the 16 strongest currencies in the world for more information.

What are some strategies for trading on safe haven assets?

When trading on safe haven assets during a period of economic instability, an investor may choose to open a long position where they think that the instrument’s value will increase, or a short position on a declining instrument. Strategies such as financial hedging or pairs trading can be practised in these instances.

Is oil a safe haven asset?

Given the frequent volatile nature of the energy markets, oil is not generally considered a safe haven asset for investors. This is because oil can be affected by the stock market, fluctuating value of currencies, political and social events, and many other factors. Read more about oil trading.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.