Traditionally, most investors have viewed their investments and trades in terms of absolute returns. In other words, if you buy something and it increases in value, there is a chance to make a profit, or it decreases in value, there is a risk of loss. Pairs trades, however, change this completely. A pairs trade involves going long on one position and short on another. Your profits on a pairs trade are based on relative returns, meaning that one position is doing better than the other. Both sides can go up, both can go down or the results can be split, but it is how the two parts of the pair fare relative to each other that matters, instead of what happens within the wider market. Pairs trading is often seen as a type of financial hedging.

A guide to pairs trading

Pairs trading is an advanced trading strategy that involves opening one long position and one short position for two financial securities. These can either come from the same market or separate markets, as long as there is a positive correlation between them.

Both short-term traders and long-term investors can use pairs trading to their advantage. It is a market-neutral strategy, meaning that the overall direction of the markets does not have a contributing effect on the positions. Instead, it is often used as a form of hedging currency risk by balancing positions that act as a hedge against each other. In order to profit from a pairs trading correlation, the trader must identify when the assets are deviating in value, calculated as the ‘standard deviation’. They can then choose to buy the long position that is undervalued and short-sell the overvalued position. Once the assets have reversed to their original positive correlation, a profit will ensue.

Pairs trading is a form of short-term statistical arbitrage, which is a strategy that relies on mean reversion to hold positions and securities for a short period of time. This strategy could be applied to financial markets including shares, indices and commodities.

Pairs trading strategy

What is pairs trading within the financial markets?

Another part of the power of pairs trading is that it can be implemented within asset classes and between classes, giving you the ability to capitalize on changes in relative values across global markets. Some of the more popular types of pairs trades include stocks, indices and commodities. Pairs trading on multiple assets can help to diversify your investment portfolio further through either spread betting or CFD trading.

Stock pair trading strategy

This relates to both pairs between stocks in the same sector, and pairs between stocks in related sectors. Events often occur that can benefit one company at the expense of another in the same industry, such as large contract awards and new product developments. These tend to occur most often in the aerospace industry and the technology sector. Example shares include Boeing vs Airbus or Coca-Cola vs PepsiCo.

You can also develop group trades for global markets with a limited number of players. For example, if you think there is growth potential for the smartphone sector, you may want to try to enhance your returns. You could set up a group trade by opening long positions for companies that you think will succeed, likely increasing their undervalued stock price, or opening short positions for companies that you think will lag behind. Among these could include blue-chip stocks such as Apple and Samsung vs Motorola and Nokia. Google and Microsoft could be included in this stock pair trading strategy as well, but they tend to have higher exposure to other markets.

Frequently, events occur that change the balance of pricing power between companies and their suppliers or customers. For example, economic or political events that result in rising oil and gas prices tend to benefit their producers at the expense of companies where fuel is a key cost. This can apply to airlines, railroads and courier services.

Index pairs trading

Most countries around the world have an index that details the largest companies on their national stock exchange. Traders who think that one country may outperform another may go long on one index and short another. Index pairing can be particularly useful where currency trading is unavailable.

If you have differing opinions about countries within a currency bloc such as the Eurozone, you could place pairs trades on indices within the area such as the DAX, CAC, IBEX, MIB, AEX or other key indices. In contrast, if you have a different opinion toward the UK separate from the Eurozone, you have the option of pairing a European index against the FTSE, or trading the forex pair EUR/GBP.

If you have different opinions about countries where the currencies are pegged, you could pairs trade their indices. For example, the US Dollar and Hong Kong Dollar are pegged and essentially untradeable, but the Dow Industrials and Hang Seng can still be paired.

Commodity pairs trading

One can often pairs trade similar commodities in order to take advantage of changes in relative outperformance or volatility, such as crude oil vs natural gas or gold vs silver. You also can trade different types of the same commodity such as crude oil from the US (West Texas) versus the UK (Brent).

It is also possible to practice pair trading strategies between unrelated commodities. For example, taking advantage of the differing growth rates between the US and China. Both copper and crude oil are cyclical commodities that tend to rise and fall with changes in global demand. Copper, however, is slightly more sensitive to the building infrastructure of emerging economies, such as China and India, while crude oil pricing tends to be more sensitive to US demand.

Futures pairs trading

Our trading platform is particularly useful when carrying out futures or forwards pairs trading, as there are tools that allow you the option to ‘buy’ or ‘sell’ the securities in your basket. You can see how one asset can affect the raw performance of all assets within the basket, with the aim of identifying products that are trending favourably in one direction or unfavourably in another direction.

Example of a pairs trading strategy

Let’s say that you decide to open a long position for gold and short an equivalent amount of silver in a pairs trade. Your returns would vary depending on how the two precious metals perform relative to each other, demonstrated in the following examples.

Both sides move up or down the same amount

If gold and silver move the same amount on a percentage basis, the returns on the two sides of the trade should offset each other. For example, if both went up 10%, the 10% gain on the long gold position would be offset by the 10% loss on the short silver position, leaving you at breakeven.

If both fell by 10%, the profit on the short silver position would be offset by the loss on the long gold position. Hence, the two positions hedge each other.

Both sides move up

If gold moves up 10% and silver climbs 8%, the 10% gain on gold would be partially offset by the 8% loss on silver, leaving you with a 2% gain.

If silver moves up 10% and gold only advances by 8%, the gain on gold would be more than offset by the loss on silver, leaving you down by 2%.

Both sides move down

Consider that both metals fall and gold drops by 8%, while silver falls by 10%. The gain on the short silver position would be partly offset by the loss on the long gold position, leaving you with a 2% net gain.

If silver were to fall 8% and gold were to drop 10%, however, the loss on the gold position would more than offset the gain on the silver position, leaving you down by 2%.

Both sides move your way

Suppose you catch a break and gold advances 10% while silver declines 8%. The 10% gain on the long gold position, coupled with the 8% gain on the short silver position gives you an 18% return on the pairs trade.

Both sides move against you

One major risk in pairs trading is that you could get squeeze if both sides of the trade go the other way. Suppose gold falls by 8% and silver climbs by 10%, the 8% loss on the gold position coupled with the 10% loss on the silver position would hand you an 18% loss on the pairs trade.

The key to profiting from an effective pair trading strategy is this: whatever you trade on the long side needs to outperform whatever you trade short, regardless of how the broader markets move.

- Open a live account to deposit funds and start trading the financial markets

- Open a demo account to practise trading risk-free with virtual funds

Fundamental and technical analysis in pairs trading

Over time, the relative valuation of physical assets tend to change, including precious metals, agricultural commodities and financial assets such as stocks and bonds. By trading pairs such as gold or silver over the Dow Industrials or other popular indices, you can try to take advantage of these changing trends.

The risk to this type of pairs trade, however, is that sometimes the relationship may be altered by outside forces. For example, West Texas and Brent Crude Oil have always traded at fairly similar prices. In early 2011, however, the Arab Spring raised the risk premium on Brent Crude Oil and opened up a significant gap between the two prices that remained for an extended period of time. This makes pairs trading particularly unpredictable within a volatile market such as the commodity market, as something like the weather can have an adverse effect on your positions. This is why fundamental analysis is so important for traders. Both internal and external factors can have an effect on not only financial securities themselves, but also the companies that are in charge of supply and demand.

As pairs trading relies significantly on mathematical data, it can be said that there is a need for both fundamental and technical analysis. Whereas some traders rely on using P/E ratios to measure correlation between securities, others choose to analyse technical price charts and graphs to find their price ratios. Within these, you can define the standard deviation between the mean price ratios and their standard deviations, giving you an indication of profit or loss. Using these technical charts can also help to determine the difference between correlation and cointegration. Pairs trading cointegration is very similar but the price ratio will usually vary around a mean.

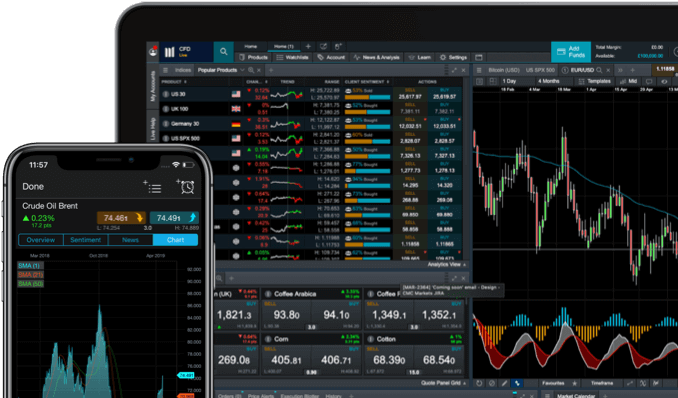

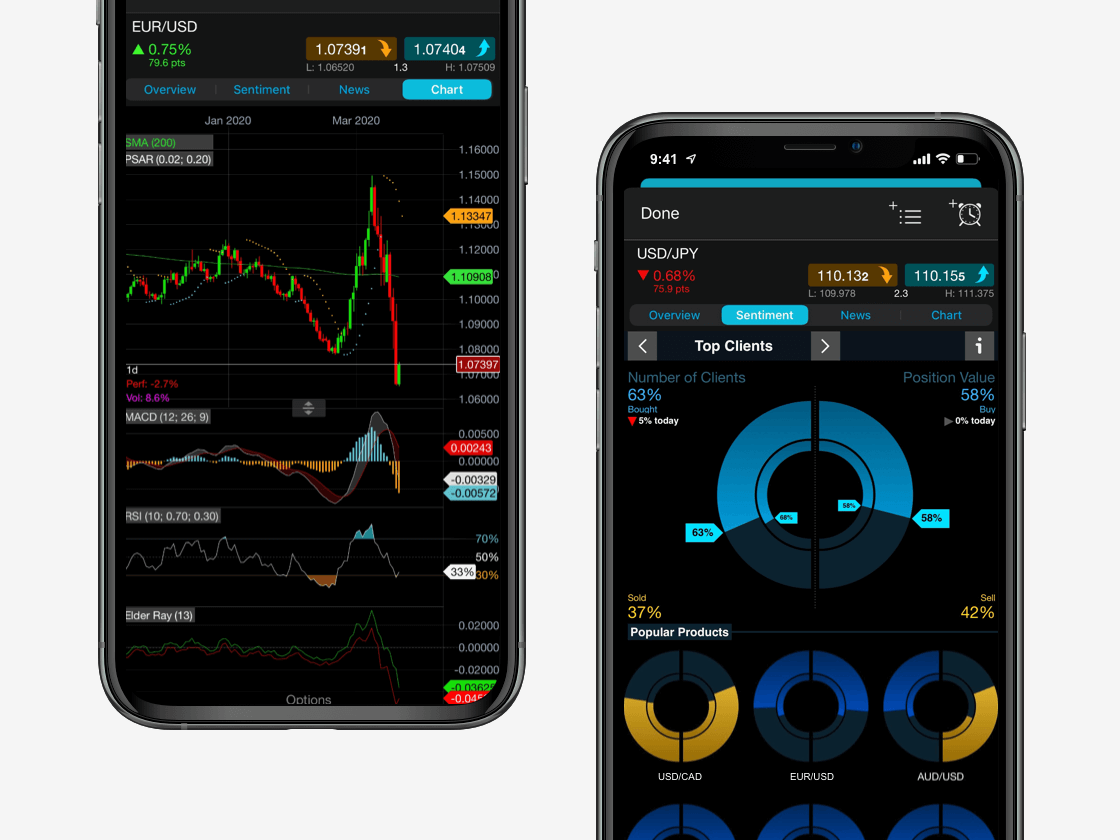

Pairs trading software

There are many more advanced technical strategies that you can incorporate within your pairs trading strategy to get the best results. Our Next Generation online trading platform can be used to perform pairs trading to an advanced level, complete with technical indicators and tools. We offer spread bets and CFDs on over 330 forex pairs, as well as over 8500 stocks, ETFs and other financial assets that can be used as hedging tools. Explore our platform features by registering for a demo account below.

Seamlessly open and close trades, track your progress and set up alerts

Summary: does pairs trading work?

Pairs trading can be a highly effective advanced trading strategy that can be applied to a variety of financial markets. However, relying on mean reversion in pairs trading can provide risks, as markets are constantly changing. A trader’s prediction that their pairs trading correlation will revert back to its original after buying and selling the positon may not always prove correct. Therefore, you need to ensure that you have a solid risk management plan for when pair trading strategies do not result in the profit that you had hoped for.