Zoom stock analysis - is Zoom stock a good buy?

Zoom Video Communications (ZM), the video-conferencing company has seen major price increases since the Coronavirus outbreak. Is the company’s stock value a reflection of the businesses promising growth? Alternatively, is the stock beginning to look overvalued? Read our full analysis for Zoom's share price this year.

What is Zoom and how does it work?

Zoom is a cloud-based conferencing software that can be used via your browser, desktop or mobile application. Zoom enables users to virtually interact with contacts when a physical meeting is not possible, such as if you work remotely. Zoom is more than a video chat software, as it allows users to record meetings, share one another’s screens and create annotations. This flexibility results in the ability to collaborate efficiently on projects for work or education.

How does Zoom make money?

A basic Zoom account is free and allows video meetings for a limited number of participants for a limited time. Following this, Zoom offers three additional packages ranging from £11.99 - £15.99* per month per host. As packages get more expensive, they reduce limits on participant numbers and meeting lengths. They also come with additional features such as cloud recording storage, dedicated support and customisation options. However, as packages get more expensive, they also require a minimum number of ‘hosts’ per package.

‘Zoom rooms’ is Zoom’s video conferencing package. Here, Zoom makes a clear distinction between meeting packages and conferencing packages. A room in currently £39.00 per month per room, and works as an ideal solution for larger companies who regularly host conferences.

For example, a multinational enterprise (MNE) that wishes to sign up to zoom may choose their enterprise package, starting at £15.99 per month for a minimum of 100 hosts - resulting in a total minimum cost of £1,599 per month.

Zoom’s stock price history

With around half of Fortune 500 companies reportedly using Zoom in 2019, it’s no surprise that Zoom’s stock price has risen drastically since the outbreak of Covid-19. The virus has caused many to work remotely, creating a larger demand for conferencing tools that enable workers and teams to keep in touch and continue collaborating.

Zoom’s IPO and stock price in 2019

Zoom video communication’s stock made its debut on the NASDAQ under the ticker ‘ZM’ on Thursday the 18th of April 2019. Zoom announced their stock would be priced at anywhere between $32.00 and $35.00. Once the stock was publicly available, the price quickly surged over 80% to $65, before ending its first day of trading at around $62.

Following Zoom’s IPO (initial public offering), it reached highs of 107.34 on June the 20th before price momentum slowed down and the price gradually fell over the next months, closing at 68.04 on the last trading day of 2019.

Zoom’s stock price in 2022

Following the Covid-19 pandemic that impacted many workers' lives throughout the world, Zoom’s stock reached a high point of approximately £570 in September 2020. Since this point, Zoom's share price dropped slightly and is currently on a downtrend, trading for approximately £330 as of March 2021. This is still a much higher price than it was trading at the same point last year.

Spread bet or trade CFDs on Zoom stock

Is Zoom stock a good buy?

Demand for collaboration tools, such as Zoom has hit a new high following the coronavirus pandemic. Most company’s employees are working from home and there is limited contact between businesses dealing with one another. A combination of these factors and the likelihood of social distancing lasting throughout 2021 could boost Zoom’s revenue accordingly.

Many analysts predict that Zoom could grow its annual revenue to around the £1bn mark by 2021, a significant increase from the £662m in 2019. Besides the spike of users from coronavirus, many companies are becoming more remote. This ‘remote working revolution’ will require effective video conferencing software, such as Zoom to contribute to the revolution.

Zoom is currently trading at an overvalued rate, with its 12-month-trailing P/E ratio approximately 444x times its EPS. However, if the company keeps building upon its financial results and gains market share in the video conferencing industry, it could result in a promising future for the relatively new company.

Trading on Zoom

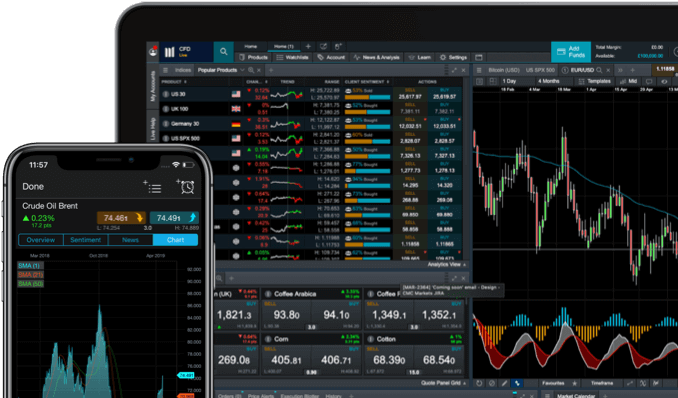

Zoom can be accessed and traded on with our selection of trading accounts. When you spread bet or trade CFDs on Zoom with us, you can access a selection of features that may not be available when trading with a conventional broker.

- You can play both sides of the market. When opening a trade you can choose to either ‘buy’ Zoom and go long, or ‘sell’ Zoom and go short.

- Trade on zoom with leverage. Lay just a percentage of the full trade value as a deposit and receive exposure based on the full trade value. Please note, that this will magnify both your profits and losses by the leverage ratio.

- Lower costs. Trading Zoom could cost less than buying and selling Zoom’s stock in certain situations.

How to trade Zoom

- Open a live trading account. Open a live spread betting or CFD trading account. Not sure about the difference? Find out the differences between spread betting and CFD trading.

- Research Zoom. Use our news and analysis section and Morningstar company reports to determine if you think the price of Zoom will rise or fall. Go long and ‘buy’ Zoom if you think the share price will rise, otherwise go short and ‘sell’ Zoom if you think the price will fall.

- Manage your risk. When trading, it is best practice to manage your risk. You can place stop-loss and take-profit orders to ensure Zoom’s price does not rise or fall beyond your expectations.

- Place your trade. Once you have determined whether to go long or short, enter your position size and place your trade.

Summary

Zoom is a relatively new company that has managed to consistently increase its revenue and earnings YoY. The recent coronavirus pandemic has resulted in the demand for Zoom’s product and services to skyrocket, resulting in a share price to reflect this increased demand.

Mixed analyst reports and volatile financial markets mean it is unknown how Zoom’s share price will fluctuate in the future. However, it managed to increase its stock price by 200% in a period when the S&P 500 dropped by 17%, and has outperformed several high-profile tech stocks like Slack and Uber.