The direct market comprises of buy side and sell side entities. Sell side entities engage in the sale of financial instruments. These could include liquidity providers and market makers. Buy side entities engage in the buying of financial instruments. These could include asset management companies and private investors. In the foreign exchange market, orders are usually placed on the order books of ECNs. In the share market, orders for DMA share trading are usually placed in the central limit order book of an exchange. ECNs and exchanges bring together buy and sell side entities. Their order books comprise of the ask prices of financial products on offer by sell side participants, and the bid prices for the same by buy side participants.

Contracts for difference (CFDs) are trades between a CFD provider and a client. A CFD does not give ownership of the underlying financial instrument to the client. It is an agreement between the CFD provider and the client to settle in cash the difference between the opening and closing prices of the CFD. The CFD provider will base the price of a CFD on the price of the underlying financial instrument in the direct market. CFDs are not traded on exchanges in the organised market and are classified as over-the-counter trades.

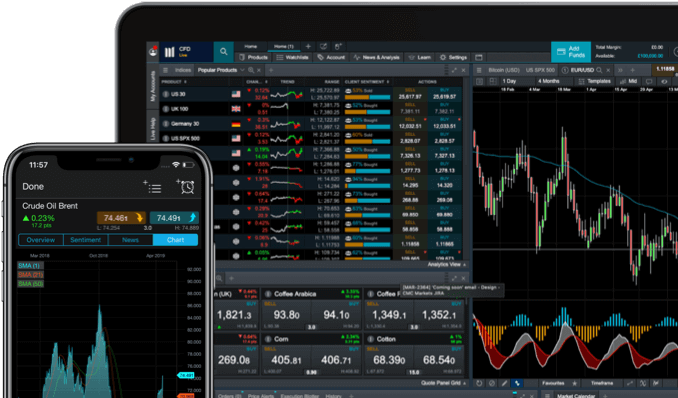

CFDs are traditionally quote driven. The CFD provider gives the trader a quote with an ask price based on the price of the underlying financial instrument in the direct market. These orders are then aggregated by the CFD provider and placed in the direct market for execution. CFD providers hedge their market exposure in this manner. A quote-driven CFD provider is therefore a market maker.

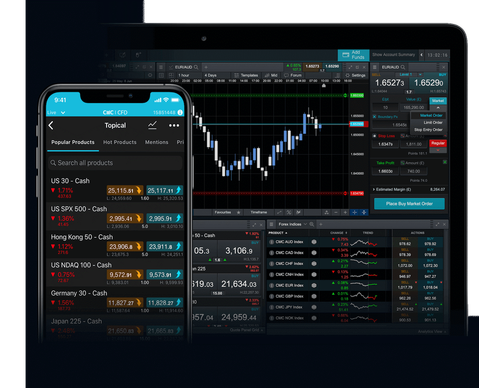

When a client trades a contract for difference using DMA CFD trading, the provider instantaneously places a corresponding order in the direct market. This hedges the CFD provider’s exposure. The order placed by the provider in the direct market mirrors the price, volume and instructions of the CFD. This order appears as an individual entry on the order books of the ECN or exchange.