If the price moves a lot in a day, especially with lots of volume, this means that a trader can enter and exit the position easily. This is one reason why volatile stocks are so popular for day trading, in particular.

A volatile stock is one whose price fluctuates by a large percentage each day. Some stocks consistently move more than 5% per day, which is the expected volatility based on the historical movement of the stock. Other stocks may only have certain days where they move more than 5%. A volatility trader can seek out either a consistently volatile stock or one that is simply showing large movements that day. You can identify the biggest risers and fallers within the share market of each trading day in the Product Library inside our trading platform, Next Generation.

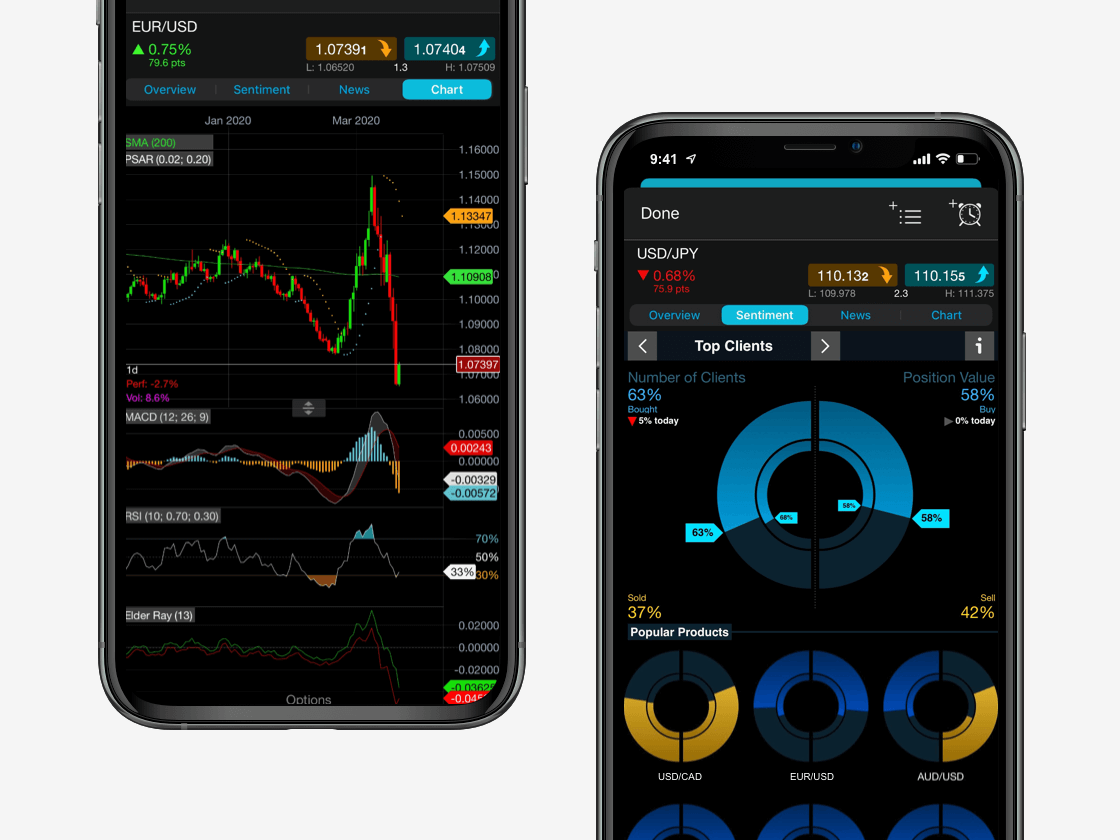

For example, when day trading volatile stocks, you can set up a five-minute chart and wait for a short-term trend to develop. For day trading, a 10-period moving average will often highlight the current trend. You should then wait for a consolidation, which is at least three price bars that move mostly sideways, and enter the position if the price breaks out of the consolidation in the trending direction. This is a relatively simple and effective way to trade high volatility stocks.

For example, as shown in the chart below, American Airlines’ stock was moving more than 6% per day for much of the first half of 2020, and often had large trending days. In this instance, a trader could place a stop-loss $0.02 outside the other side of the consolidation. Then, a target should be placed at two times the risk. The risk is the difference between the entry and stop-loss price. In the example below, a downtrend is in progress. A consolidation forms with a low of $12.975. A short entry could be taken when the price drops $0.01 below, at $12.965.

The top of the consolidation is $13.035, and a stop-loss could be placed at $13.055. The risk on the trade is $0.09 per share (calculated by $13.055 – $12.965). The target is an $0.18 profit per share, placed at $12.785.