-

- International (ENG)

5G is the fifth generation of mobile networks and is expected to be the future of mobile technology. Join us as we review some of the best 5G stocks you can invest in or trade on in 2022. In this article, we analyse past performance and market analyst estimates to provide objective information that can help you make future investment decisions in the 5G revolution.

Wireless mobile technology has been constantly evolving over the last 40 years, as technology developed and usage became more widespread.

While the expansion of 5G is increasing rapidly, it's not expected to be globally available until 2025. Many companies are aiming to be at the forefront of this 5G revolution, capitalising from the widespread adoption of wireless technology.

We review a selection of 5G stocks that are directly related to the building and adoption of the 5G network, not on their investment potential. The below information should be used as a guide to help determine which stocks you find interesting, and it's important to then conduct your own research before investing.

Qualcomm is a technology company headquartered in San Diego, California. They design and create software and chips for use in wireless equipment like mobile phones. Qualcomm also develop and commercialise wireless technologies and have previously licensed many technologies related to 3G and 4G technology.

For 5G technologies, more connected devices result in greater income for Qualcomm, due to growth in licensing sales. Last year Qualcomm reached an agreement with Apple for the supply of their chipset in a multi-year deal, concreting the pivotal role Qualcomm could play in 5G technologies. As 5G goes beyond mobile phones, it presents a big opportunity for Qualcomm; its chips enable communications in everything from IoT devices to autonomous cars.

Qualcomm is a profitable company with a market cap of around $91bn and has paid a consistent dividend, even following the Covid-19 crisis. The company has a strong balance sheet with lots of cash at hand to weather hard times and drive innovation. More information on Qualcomm's share price >

Ericsson is a telecommunications equipment and services company headquartered in Stockholm, Sweden. They offer services, software and infrastructure in information communication technologies and have around a 27% market share in 2G/3G and 4G mobile network infrastructures. It's no surprise that Ericsson is heavily invested in the 5G revolution.

Ericsson provides hardware and services that help telecom providers upgrade their networks to accommodate the speed increases of 5G technology, with 81 deals signed by February 2020. Additional to the agreements Ericsson boasts, 25 of its networks are also live. In terms of 5G, Ericsson has a strong position, being the first company to deploy 5G networks across four continents, and claiming it supports the largest range of supported devices for 5G connections.

Ericsson is a profitable company, with a market cap of around $29bn. ERIC has also paid a fairly consistent dividend and noted that Covid-19 had a limited impact on its operating income and cash in the first quarter of 2020. With its strong position and fundamentals, Ericsson has the chance to be at the forefront of the 5G revolution. More information on Ericsson's share price >

Nokia is a telecommunications and consumer electronics company headquartered in Espoo, Finland. Shortly behind Ericsson, Nokia claims 67 5G contracts and currently has 19 live networks. Nokia currently holds a market share of around 27% outside of China and boasts than it has won 100% of the contracts it has gone for outside of China, and 90% in China.

Nokia is a successful company with a market cap of around $24bn, and pays a strong dividend for the company’s positioning. Considering these factors, Nokia could be a good 5G stock to buy that is not a market-leader. Stocks that are market-challengers can provide an interesting investment opportunity as they can sometimes beat market expectations. More information on Nokia's share price >

Verizon is a telecommunications provider headquartered in New York, U.S. Verizon chose Ericsson to help upgrade their core network so it is capable of managing 5G speed and communication upgrades. Verizon is hoping to drive its future profitability by the growth in its wireless technologies.

Verizon is the largest wireless communications service provider in the U.S. boasting a market share of 35% and a market cap of around $230bn. Verizon currently also offers the highest dividend on the list and its earnings report following the Coronavirus market crash of March 2020 demonstrated its strength and reliance to weather hard times. The stock holds good potential for future growth based on the above information, especially considering the possible future utility of the 5G network. More information on Verizon's share price >

When investing in 5G stocks, it can be hard to determine who the winners and losers will be, as 5G still has a long way to go. A common way to get exposure to an industry or technological development in a simple manner is with an ETF (exchange-traded fund) or share basket. These products help provide exposure to a variety of stocks that are related to 5G technologies. This helps spread the risk between multiple companies, but is treated in a similar way to an individual stock.

Our 5G share basket helps provide exposure to 21 stocks related to 5G technologies. Our analysts have done the hard work to discover current and emerging trends driving the 5G sector, and companies well-placed to succeed. To trade on our 5G share basket, you can open a live account or demo account.

Interested in the digital generation? We offer a range of similar share baskets, including streaming stocks, gaming stocks and Big Tech.

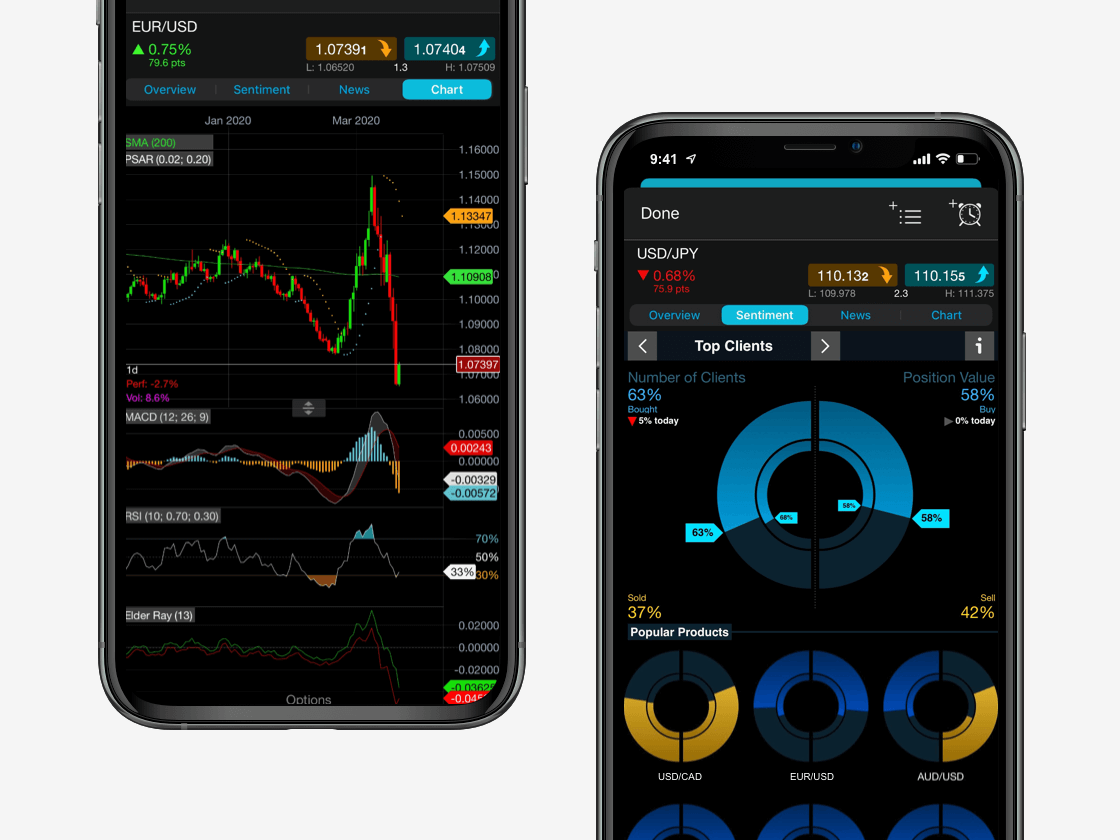

Seamlessly open and close trades, track your progress and set up alerts