A guide to Tencent stock

Tencent is a Chinese multinational technology company that owns a number of well-known subsidiaries within the technology and entertainment industries. Founded in 1998, the company listed on the Hong Kong Stock Exchange in 2004, where investors could start to buy and sell Tencent shares. Tencent is one of the largest tech companies worldwide and it has evolved by expanding its range of activities, not only across Asian markets but also on a global level.

What companies does Tencent own?

As Tencent is also a conglomerate holding company, it owns a number of brands within multiple sectors. We explain these in more detail below.

Social media

- QQ is one of the most commonly used Chinese instant messaging services. QQ also offers users the chance to listen to music, play online games and do their shopping.

- WeChat is a social network platform where users can share their photos, videos, and make free video calls, as well as order food, taxis, flights and train tickets. Furthermore, it has its own payment system, which is accepted everywhere in the country. As of 2021, WeChat’s monthly active users has increased to over one billion.

Music

- Tencent Music Entertainment is a popular music stock that develops and owns the majority of China’s streaming music services. This company is a joint venture between Tencent and Spotify. Apps include QQ Music, WeSing and JOOX, which have more than 800m active users. The company had their IPO in 2018, so you can trade on our Tencent Music Entertainment share price here.

Video games

- Tencent Games is a video game publisher that owns four game development studios across the country. Under this subsidiary, Tencent has developed and published a number of games, some of which are among the highest-grossing games of all time, in terms of revenue.

- WeGame is Tencent’s flagship game portal. It hosts games, content and services from all over the world and users can interact and live stream their gaming within a variety of communities.

E-commerce and banking

- TenPay is a major payments solution that enables customers to pay online and cross-border. A similar platform to PayPal, it can support B2B, B2C and C2C payments. TenPay wallets are compatible with e-banking and most major domestic banks.

- WeBank is the first Chinese-only online bank. It does not have any physical branches or outlets but instead focuses on facial recognition technology in order to approve payments.

Tencent consistently features on annual lists of the world’s most valuable brands, and often tops the list as the most valuable Chinese brand.

Is Tencent publicly traded?

Tencent stock is listed on the Hong Kong Stock Exchange, where local traders can buy and sell shares. It is also a constituent of the Hang Seng Index, which measures 50 of the largest market-cap companies on the Hong Kong stock market.

Even though it is not amongst the most well-known shares, as it is not listed directly on a US-based exchange, those who follow the gaming industry may see it as a diverse and worthwhile company. The gaming sector offers large growth opportunities, especially in Asia, where it has been growing steadily for many years and moves more money that the film industry. This perhaps gives Tencent’s share price an opportunity for fast growth.

The fact that Tencent is a Chinese company, however, has its downsides. The Chinese government has a lot of power over the industry and often limits or blocks video games based on arbitrary control policies that subsequently have an effect on the performance of gaming stocks. Advertising in China is also an issue. Further advertising would allow Tencent to increase its already huge profits; however, it has been greatly limited by the central government.

Despite these drawbacks, Tencent Holdings is growing at the levels of its major international rival companies, such as Microsoft and Sony.

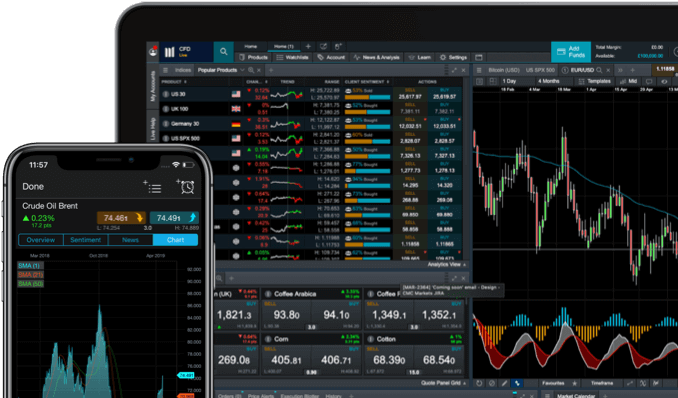

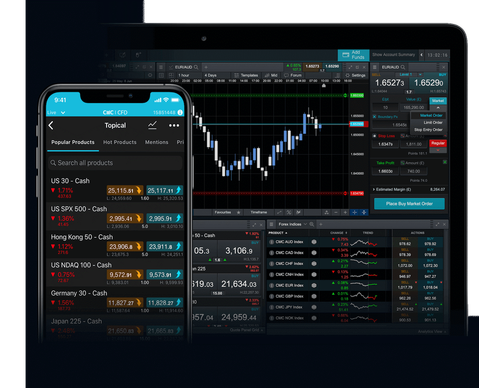

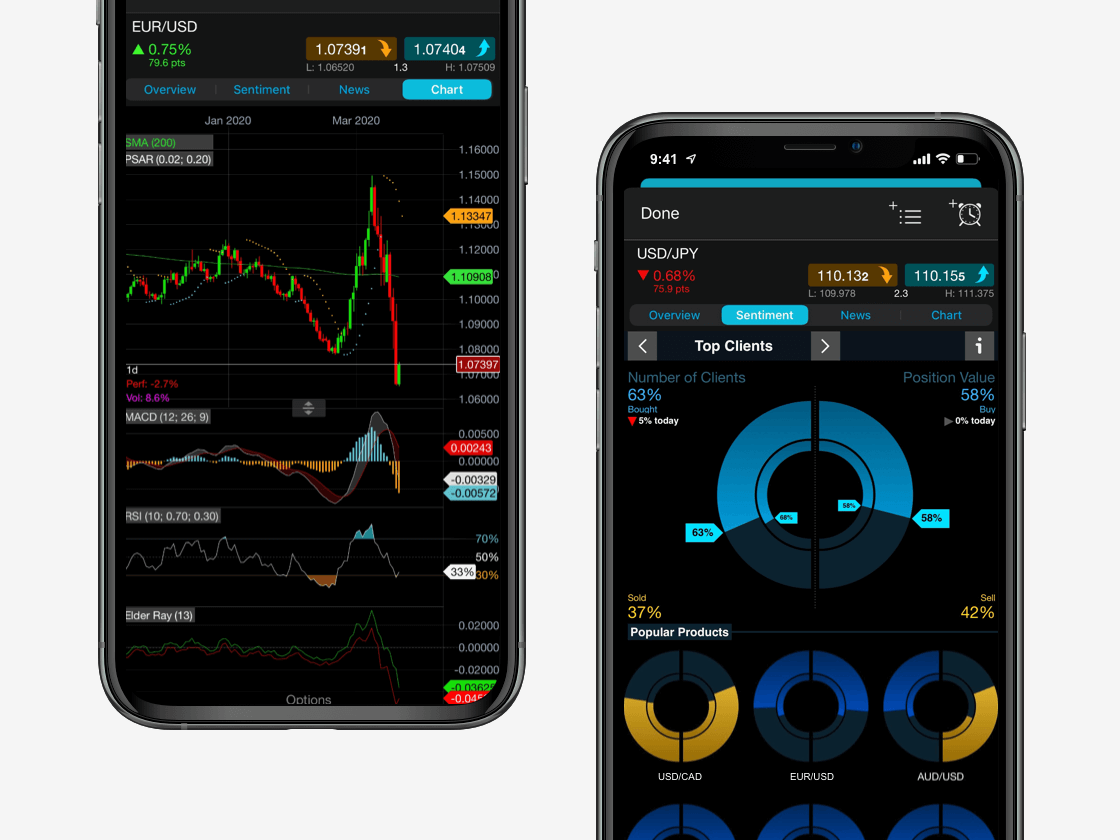

Trade on Tencent stock on the go

Seamlessly open and close trades, track your progress and set up alerts

Tencent stock forecast

As discussed, the gaming sector is providing a great boost for Tencent and we could expect revenue growth again this year, after Tencent’s end of year report boasted a 29% rise in 2020. This suggests that the company may be a promising Chinese stock to look out for in the share market.

Tencent’s gaming portfolio includes hits like Honor of Kings, Peacekeeper Elite, PUBG Mobile, League of Legends and Clash of Clans. It currently publishes four of the top ten iOS games in China.

Its financial and business service generate most of its revenues from Tencent Cloud, the second largest could platform in China after Alibaba Cloud. WeChat Pay and Alipay (by Alibaba) have a duopoly over the digital payments market. The Tencent advertising sector also sells ads on WeChat, its other apps and Tencent Video, a streaming video platform.

How to trade on Tencent shares

- Open a trading account. Choose between spread betting, which is tax-free in the UK*, and CFD trading, which is available globally. You will be granted automatic access to a free demo account, where you can practise trading first with virtual funds.

- Devise a trading strategy. Decide whether to open a long position (buy) if you think that Tencent’s stock price will rise or open a short position (sell) if you think that Tencent’s stock price will fall.

- Stay up to date with market news. Our news and analysis section is updated daily with insights and reports from our expert market analysts. This includes the share market but also forex and indices, which could have an impact on the rest.

- Apply risk-management controls. Stop-loss orders are important when placing trades on a potentially volatile market and can help to control losses.

- Monitor your positions. Brush up your knowledge of fundamental and technical analysis in order to analyse and understand price charts, trends and reversals.