There are some investors who view a market correction as an opportunity for gain. They may look for lower share prices with the aim to profit when the market reaches an equilibrium and recovers.

In a stock market correction, other investors look to trade on less volatile assets, like consumer-staple stocks. This is because they are often thought to be more stable during a correction, rather than small-cap stocks within volatile industries. Therefore, traders may seek to trade on stocks of companies who deal with essential and every-day produce. Examples include large-cap or blue-chip stocks, which are seen by some investors as more reliable and stable within the stock market. However, as explained previously, this may not always be the case and these types of stocks can still result in losses.

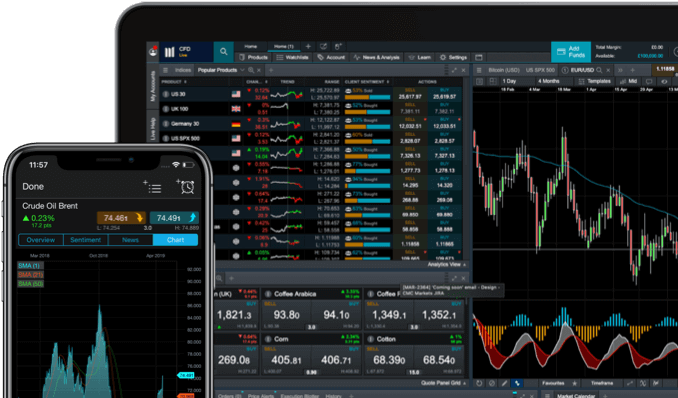

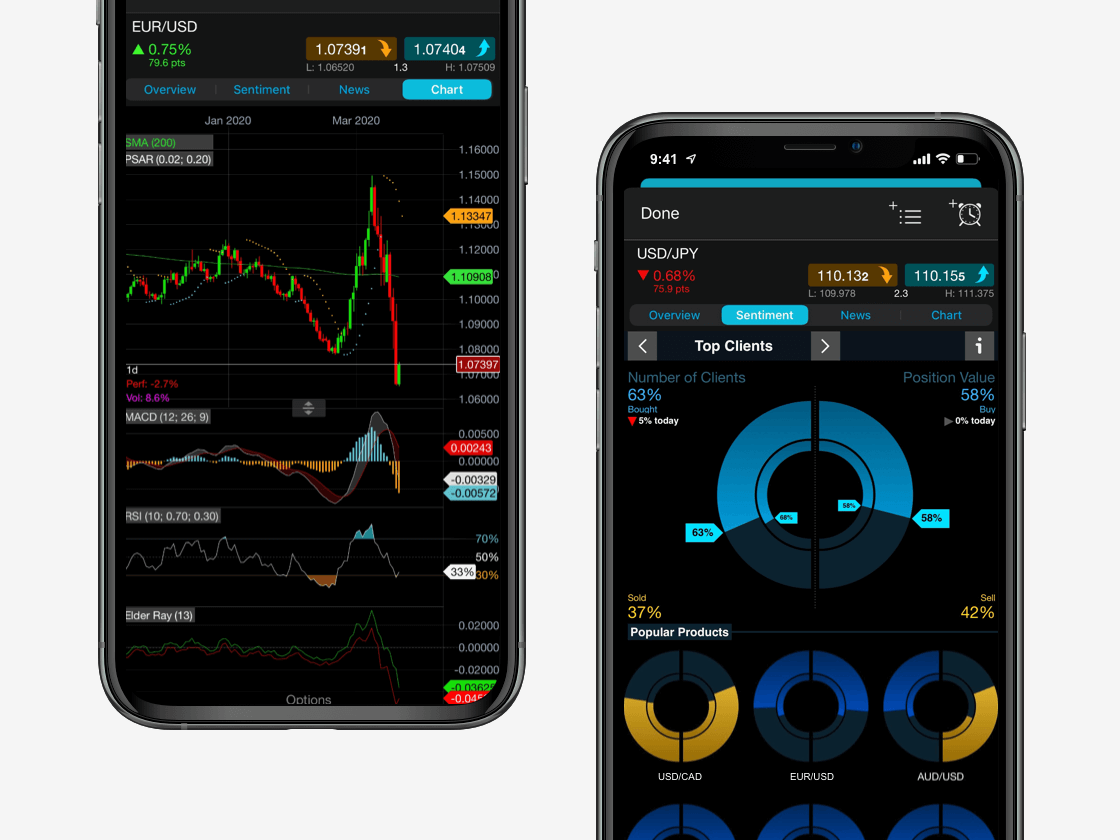

Many shares lose value in a market correction and traders may look to profit by shorting the market. This strategy can be achieved by way of spread betting or trading CFDs, which are derivative alternatives to investing in physical shares. In particular, spread betting is a tax-efficient* way of speculating on the price movements of the underlying assets, and CFD trading allows traders to buy or sell a number of units for an instrument, with the difference in price being exchanged at the end of the contract.

Until the market recovers, traders may aim to profit by way of shorting stocks with derivative products in order to reduce the losses from shares investments that they wish to keep open. You can spread bet and trade CFDs on our award winning** Next Generation trading platform by opening an account.