Quant trading

Quantitative trading or quant trading is a trading style based upon quantitative analysis. Quantitative analysis in trading relies on mathematical modelling and computer algorithms to identify trading opportunities. An asset’s variables such as its price or trading volume are some of the inputs regularly used for mathematical modelling.

There has been a recent surge of individual investors adopting quantitative trading strategies. Traditionally, quantitative trading strategies were predominantly used by either financial institutions or hedge funds. When these large enterprises utilise quant trading as a strategy, thousands of stocks or other instruments are often bought or sold, usually amounting to hundreds of thousands in value of transactions.

Quant trading is a trading style that is increasingly becoming adopted by individual traders. Read on to discover what quant trading is, how it works and how to get started. We will cover examples of quantitative trading and many popular quantitative strategies.

Quantitative finance

Quantitative finance uses mathematical models and extensive data analysis in finance in order to apply this to the financial markets. By investigating securities, quantitative analysis can help to identify undervalued equities or bonds, for example, to predict future possibilities within trading.

What is quant trading?

Quantitative trading algorithms are designed based on a trader’s research, their preferences and the asset type. For example, if a trader is interested in momentum trading or trend trading, they may choose to write (or buy) a relatively simple program that would pick stocks based on a market uptrend. The program would follow the upwards trend of the market and purchase stocks automatically based on simple parameters.

Although this is a simple example of quant trading, multiple parameters can be used to narrow down the selection and purchase of assets. Traders can use a blend of both complex fundamental and technical analysis variables, resulting in an efficient and standardised method to pick assets.

Quantitative trading strategies

A quant trading strategy would aim to identify a profitable trade based on a number of parameters. However, it is very difficult to design a consistently successful algorithm. Some popular strategies in quantitative trading include:

Join a trading community committed to your success

Arbitrage

Although they are few and far in-between, arbitrage opportunities do exist. A trader using a quantitative trading strategy can define their algorithm’s parameters to spot arbitrage opportunities.

Arbitrate in trading can be when a stock is listed in multiple markets at a different price. Quant traders can design algorithms to scan markets and purchase dual-listed stocks at a lower price and selling them at a higher price in a fraction of a second.

Trend chasing

The most popular quant strategies involve trend chasing and momentum trading. Similar to our example above, traders who design trend-chasing algorithms utilise technical indicators such as moving averages and strength indicators. Trades are then executed based on trends that follow the set parameters. This can be a relatively straightforward strategy as many quantitative traders use simple moving averages as a main indicator.

Advantages of quantitative trading

- The use of backtesting: applying a quantitative strategy to past data to see how it would perform.

- Removal of human error and trading based on irrational emotions.

- Speed of market analysis and execution.

- Keeps trades consistent and disciplined.

Disadvantages of quantitative trading

- Difficult to develop a successful algorithmic model.

- Algorithms must be updated in reaction to market changes.

- Can perform poorly if set up incorrectly.

- Prone to mechanical failures.

How to become a quant trader

As quant trading is such a complex method of trading, any hopeful quant trader should have a strong background in maths and data analysis as number crunching large data sets is a regular occurrence. Some other factors a quant trader should possess include:

- Remarkably skilled in mathematics and statistics, a quant trader should be comfortable reading and analysing data sets that include thousands of assets.

- Besides mathematics, other relevant study paths can include engineering or financial modelling.

- Experience in the fields of data analysis, data mining, data researching and sectors based on automation can be advantageous.

- Ability to stay up to date with markets and have the psychology of a trader. That is, coping well under pressure and working long hours.

- Quant traders will have to be risk tolerant as quant trading usually requires large position sizes in several assets based on a single strategy. Risk management tools should be used to help automate quant trading further.

- Traders will have to stay adaptable and update their strategies regularly as no algorithm can consistently profit from a dynamic market.

- Knowledge of at least one programming language is critical, and the more languages a quant trader knows, the better.

Quantitative trading platform

When trading with us you can choose to open an MT4 trading account, which features expert advisors (EAs). Expert advisors are trading programmes which allow you to develop algorithms for any automated trading strategy. Designed to be efficient, flexible and functional, a MetaTrader 4 account can use a large set of indicators to analyse the market while the Expert Advisor trades them. Once set up correctly with appropriate risk management conditions, MT4 requires little human intervention and reaps all of the benefits of quant trading.

Open an MT4 account here to test out how expert advisors work.

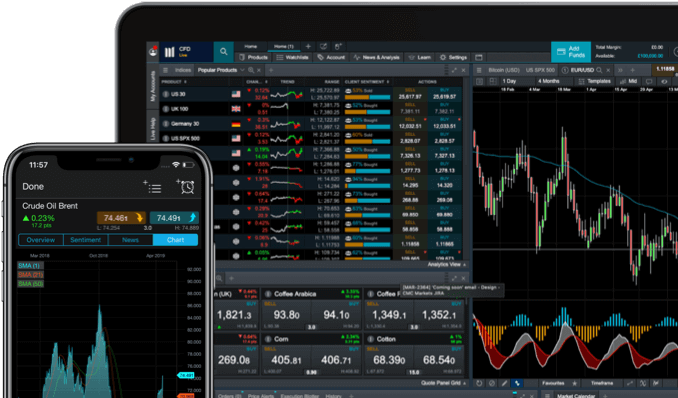

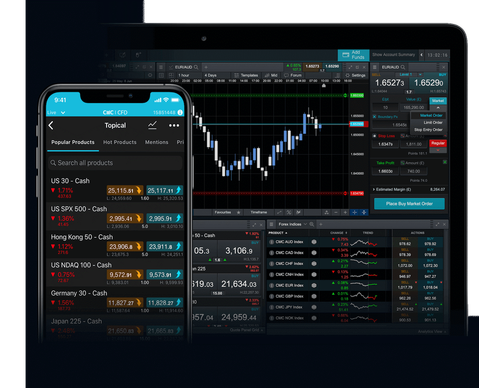

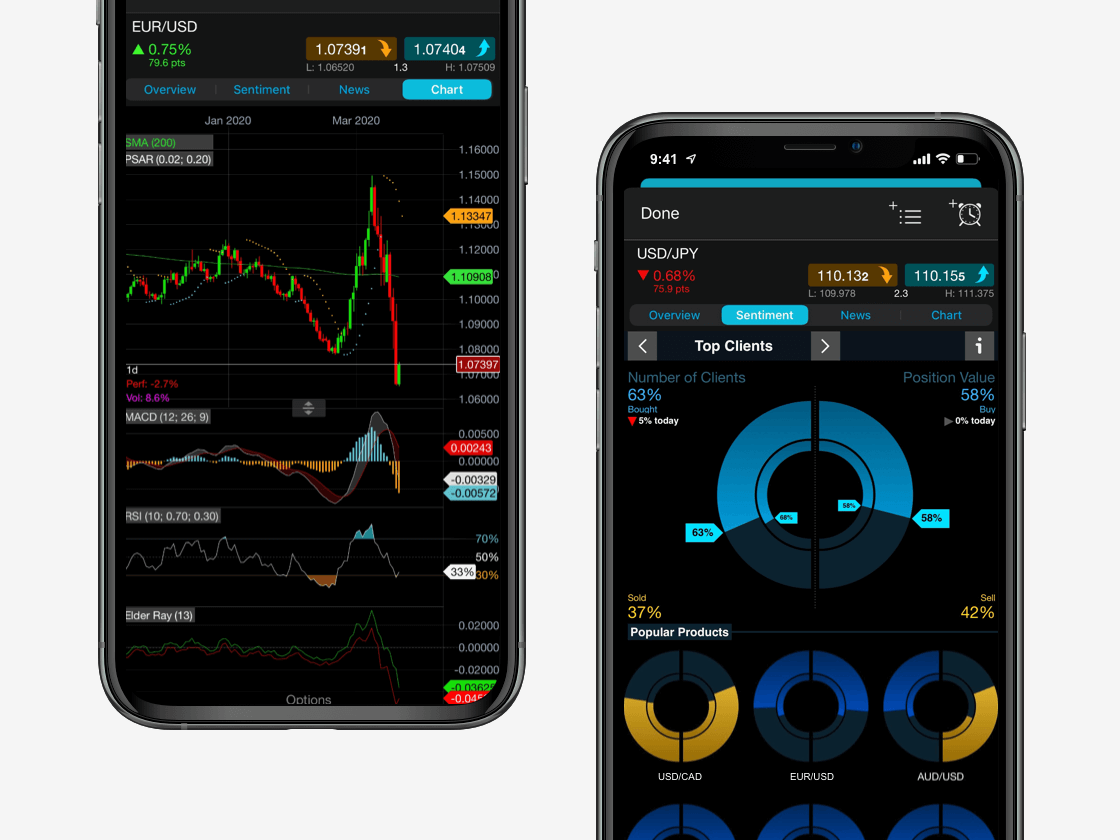

Powerful trading on the go

Seamlessly open and close trades, track your progress and set up alerts

Summary

Quant trading is a highly skilled niche within the trading sector. Besides being competent trading markets in general, quant traders must have advanced additional skills in mathematics, programming and finance. However, the key to quantitative trading’s popularity is the rise in artificial intelligence and automation. Therefore, quant trading is a growing market sector that can be very beneficial for someone who has the right skill set.