Investing in lithium

Among its several industrial uses, lithium is an integral component in the production of rechargeable batteries. These batteries are used to power portable devices, such as smartphones and tablets, feeding the increasing demand for ‘energy on the go’ products. Lithium is also used in developing batteries for electric vehicles, such as cars and scooters, which has seen production levels increase greatly since it first began. There are many other uses for lithium, such the creation of ceramics and glass.

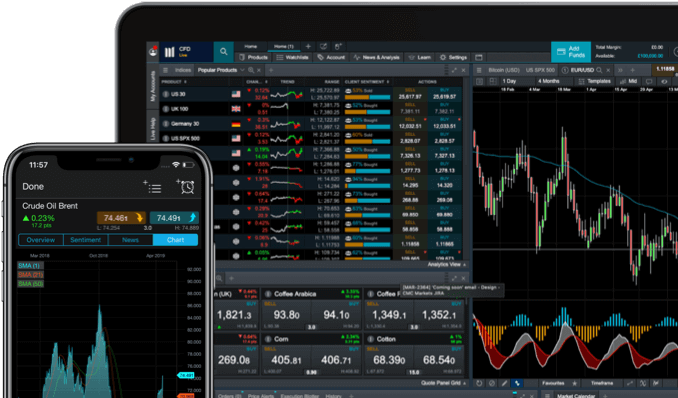

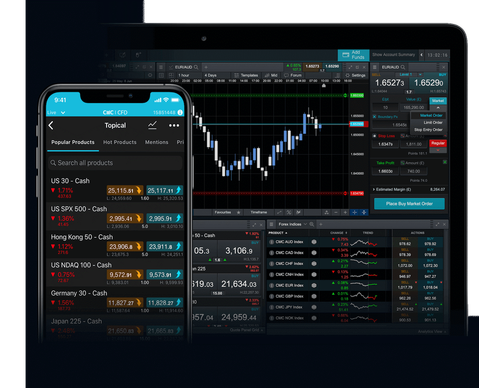

Investing in lithium is becoming increasingly popular. Read on to learn about the rise of lithium stocks and ETFs, and how you can trade on them on our award winning* Next Generation spread-betting and CFD trading platform.

What are lithium stocks?

Lithium stocks are the shares of companies that engage in the mining or processing of lithium. Unlike other precious metals such as gold and palladium, traders are not able to invest in lithium as a commodity. Instead, they can gain exposure through investing in publicly traded lithium companies. This is similar to physical uranium and uranium stocks.

Lithium is mainly sourced from spodumene mines or extracted from brine deposits. As one of the world’s largest producers of lithium, Australia contains the most spodumene mines. Brine production is mainly concentrated in South America. The two main types of lithium produced by companies are lithium carbonate and lithium hydroxide.

As expectation grows, developers are focused on trying to create lighter and faster products and are concerned about the types of lithium used in the production of their products. Where renewable technology is growing rapidly and huge companies like Tesla are relying on lithium as a key ingredient of its products, the demand for lithium has increased greatly. Where some traders are worried by possible volatility in the market, other traders view investing in lithium as a great opportunity to gain potential reward from a market that has seen a rapid rise in demand.

Traders can invest in lithium mining stocks, which are shares of companies that are involved in the mining of lithium, and lithium battery stocks, reflecting companies that develop the batteries. It is also possible to trade shares of companies that are involved in both.

How to trade on lithium shares

Investing in lithium involves the traditional method of purchasing shares of companies within the industry and holding them for a long period of time in the hope of making a profit. Alternatively, you can trade on the underlying price movements of lithium shares through spread betting or CFDs. Spread betting is a tax-efficient** way of speculating on the price movements of the underlying assets without taking ownership. CFDs allow traders to buy or sell a number of units for an instrument, with the difference in price being exchanged at the end of the contract.

- Open a trading account. With CMC Markets, you can open a live account to spread bet or trade CFDs on lithium stocks.

- Research to find the right stocks for you. Use our news and insight tools to keep track of news about lithium and the overall industry.

- Determine your strategy. Decide your entry and exit points based on your trading strategy. Depending on how the instrument’s price fluctuates, you may decide to ‘go long’ and buy, or to ‘go short’ and sell.

- Manage your risk. Before placing your trade, make sure you have understood and followed risk-management guidelines.

- Determine your position size and place the trade. Apply any risk-management orders, such as stop-loss orders, and confirm your trade.

- Monitor your position and close your trade. If you’re making a profit on your position, you may wish to consider sticking to your trading plan and close out when the target price is reached.

Lithium stocks to watch in 2022

Albemarle (ALB)

US-based company Albermarle is one of the largest providers of lithium for batteries that power electric vehicles. It produces both types of lithium, carbonate and hydroxide, as the company sources lithium through its brine and rock mining operations within several countries. As well as being immensely successful in the electric car industry, the company also produces over 100 lithium-based products for a range of other industries. In order to protect itself from any great potential losses from volatility in the market, Albermarle can also benefit from the successes of its bromine segment.

Sociedad Química y Minera de Chile (SQM)

Chilean chemical company Sociedad Química y Minera de Chile is one of the world’s biggest lithium producers. Founded in the late 1960s, the company benefits from the fact that its home country has one the largest lithium reserves in the world. Given the fast-growing demand within the electric vehicle industry, Sociedad Química y Minera de Chile expanded their production of lithium to both the main types – carbonate and hydroxide, which it produces in the Salar de Atacama in the Atacama Desert of Northern Chile. The company also benefits from its production of potassium nitrate and iodine.

Trade on 9,000+ shares and ETFs

Orocobre (OROCF)

Orocobre Limited is an Australian mineral resources company. The Brisbane-based company focuses on lithium and other mineral mining operations within Argentina. Orocobre is in partnership with Toyota Tsusho, and they are looking to grow its Argentinian-based flagship project, the Olaroz Lithium Facility. The capacity of this facility has increased to over 17,000 tonnes per annum of lithium carbonate. The two companies are also looking to construct a plant in Naraha, Japan, in order to expand their production of lithium hydroxide.

Galaxy Resources (GALXF)

Australian mining company Galaxy Resources Limited has lithium mining operations in Australia, Argentina and Canada. The company is involved in mineral exploration and processing with its main activities focusing on the production of lithium carbonate. Galaxy Resources’ Australian segment operates the Mt Cattlin spodumene mine in Western Australia, and in 2016, it merged with its partner, General Mining Corporation. The Argentinian segment operates the Sal de Vida lithium brine project, which is located in an area that produces more than 60% of global lithium supply.

Livent Corp (LTHM)

Livent Corp is an American lithium company. It owns and operates a mine in Argentina, which is the key to the company’s success in terms of its output and production of lithium hydroxide. As well as supplying lithium for products with special performance requirements, Livent also produces other types of lithium, which can be used in pharmaceutical products and non-rechargeable batteries. The company is one of Tesla’s main suppliers of lithium. With the aim to expand its presence in Europe and America, Livent became a part owner of lithium mining company, Nemaska Lithium, which own and operate a large mine in Canada.

You can trade on these stocks on our Next Generation platform through spread betting and CFDs. View our Product Library in order to discover further lithium share prices.

Lithium ETFs

An alternative way of investing in lithium is by trading lithium ETFs. Exchange-traded funds (ETFs) are investment funds that consist of a compilation of assets; in this case, multiple shares of lithium-based companies. With our Next Generation platform, you can trade on the following ETFs:

ETFs allow you to gain access to the lithium market by providing exposure to underlying share prices, and to potentially gain from it too. Due to the fact that the risk is spread across multiple securities at the cost of only one trade, many consider ETFs to be a low-risk investment.

However, remember that leveraged ETFs are complex financial instruments that carry significant risks. Certain leveraged ETF's are only considered appropriate for experienced traders.

Investing in lithium with CMC Markets

In summary, given that lithium is a key component of producing rechargeable technology, the demand for the precious metal has grown rapidly. With the hope that the demand will continue to rise, many traders view lithium as an attractive investment right now.

Register for an account to start spread betting and trading CFDs on lithium stocks or ETFs. Understanding the risks of trading with derivatives is important, and can be understood further by reading more about leveraged trading.

You can take advantage of our Next Generation platform filtering feature by focusing on specific types of stocks. The example below shows how traders can narrow their focus down to viewing ‘mining’ stocks on our Product Library, which may help to highlight companies related to lithium. Users can also enter terms such as ‘lithium’ directly in the search function to discover more relevant stocks and ETFs that are available to trade on.

Explore our platform video guides library to learn more about platform features.

FAQ

What are lithium stocks?

What are lithium stocks? Lithium stocks are the shares of companies that engage in the mining or processing of lithium. With our Next Generation trading platform, you can invest in lithium by spread betting or trading CFDs on lithium stocks.

What are examples of lithium stocks?

What are examples of lithium stocks? Examples of lithium stocks are the Chilean chemical company Sociedad Química y Minera de Chile and Albermarle, which are two of the largest providers of lithium for batteries powering electric vehicles. Browse more instruments on our Product Library in order to discover further lithium share prices.

Can I trade lithium ETFs?

Can I trade lithium ETFs? You can trade on lithium ETFs on our platform with CMC Markets, which include the Global X Lithium & Battery Tech ETF and the Amplify Lithium & Battery Technology ETF. Read more about how to trade ETFs.

*No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report.

**Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.