Healthcare stocks and ETFs

Just like food and water, healthcare is a necessity for everyone, regardless of age, gender or country of residence. As a result, some investors may view the healthcare sector as a great opportunity. Read on to discover some healthcare stocks to watch right now, based on their innovative research and development and growth potential.

What are the different types of healthcare stocks?

Because healthcare represents such a huge sector, there is a number of different types of healthcare stocks, which include the following:

- Pharmaceutical stocks. Pharmaceutical companies manufacture, distribute and retail drugs for the treatment and cure of diseases.

- Medical equipment stocks. Some healthcare companies develop and manufacture medical equipment for use in operating rooms, hospitals and clinics around the world.

- Biotech stocks. Biotech companies harness technology to create drugs from biological organisms, often through the manipulation or exploitation of living systems.

Where are healthcare stocks today?

The COVID-19 pandemic has had a profound effect on global economy and politics. Specifically, it highlighted the importance and relevance of the healthcare industry to investors. It is no surprise that healthcare stocks, together with food, consumer goods and streaming stocks, have continued to perform well despite the worldwide collapse of the economy. Approximately $8trn are spent annually on healthcare across the world and these numbers are only bound to increase if we take into account the fact that the world population is constantly growing, along with the introduction of novel illnesses like coronavirus.

How to trade on healthcare stocks

- Open an account.

- Choose your product between spread betting, which is tax-free in the UK*, and CFD trading, which is available on a global level.

- Both products require the use of margin or leverage, so read more about how to trade with leverage in order to understand the risks associated.

- Research the healthcare market. Developments in scientific research, along with updates on the Covid-19 crisis, can have an affect on healthcare share prices.

- Use risk-management controls to minimise losses on your open positions.

Healthcare stocks to watch

Bio-Rad Laboratories (BIO)

Bio-Rad was founded in 1952 in California. Since then, the company has developed and marketed tests and diagnostic systems for use in medical analysis laboratories, blood transfusion centres and industrial control laboratories. The company ranks very high in terms of quality control management systems and is a leader in screening for AIDS, hepatitis and autoimmune diseases. It is ranked 9th in the world for in-vitro diagnostics. Today, the company employs over 8,000 people in 150 countries.

Biogen (BIIB)

Biogen is an American biotechnology company specialising in the discovery and development of treatments for neurological conditions and diseases. Biogen was founded in 2003 by the merger of two world leaders in biotechnology: Biogen and IDEC Pharmaceuticals Corporation. In January 2015, Biogen acquired Convergence Pharmaceuticals, a British company specializing in chronic pain treatments, for $675m. In March 2019, Biogen announced the acquisition of Nightstar Therapeutics, a gene therapy company, for $800m.

Cardinal Health (CAH)

Cardinal Health provides healthcare products and services for hospitals, medical offices and pharmacies. Its stated goal is to reduce costs and improve safety and service quality for patients, while at the same time increasing profits. The company has developed leading technologies, such as Alaris IV pumps, Pyxis automatic dispensing systems, MedMined data mining software and the CareFusion patient identification system. Additionally, the company also manufactures medical and surgical products and is a leading provider of pharmaceutical and medical supplies.

Corcept Therapeutics (CORT)

Corcept Therapeutics is a pharmaceutical company primarily focusing on investigating the side effects of excessive cortisol production. It discovers and develops cortisol modulators for the treatment of psychiatric, oncologic and severe metabolic disorders. The company was founded in 1998 and has headquarters in California. Korlym is Corcept Therapeutic’s only product, which is used to treat around 1,000 patients annually in the US for hyperglycaemia.

Quidel (QDEL)

Quidel is an American healthcare company operating in the field of rapid diagnostic testing, cellular-based virology assays and molecular diagnostic systems. It develops and sells viral tests for the detection of chicken pox, flu and sore throats. In 2020, Quidel developed an effective antigen test for Covid-19 that was authorised in the US for emergency use. Over the past five years, Quidel's earnings per share have grown by an average of 98% annually, making it one of the fastest growing healthcare stocks on the market.

Trade on healthcare stocks with us

Small-cap healthcare stocks

Small cap stocks are defined as such based on their market capitalisation (between $500m and $2bn) and are often undervalued compared to large-cap stocks. Although these stocks receive less attention from investors, their smaller size may give some greater growth potential and consequently, the opportunity for higher earnings. We have selected two small-cap stocks that have shown promising growth potential over the past year.

NanoString Technologies (NSTG)

NanoString Technologies is a healthcare company specializing in the development and distribution of cancer diagnostic tools. The company's technology allows a wide range of basic research and translational medicine applications. In particular, it has developed new applications for its instrument system for micoRNA analysis and gene expression analysis, with the most recent launch being in2019. NanoString’s share price doubled in 2020 after a number of healthcare developments.

Cara Therapeutics (CARA)

Cara Therapeutics is a clinical stage biotech company focusing on the development and commercialisation of new pain and anti-itch products. Its products currently undergoing clinical trials aim to target opioid receptors. The company is also conducting preclinical studies on cannabinoids for the treatment of neuropathic pain, making it a popular cannabis stock option. To find out more information on the cannabis industry, read our article on marijuana stocks.

What are healthcare penny stocks?

Some traders take an interest in penny stocks., which trade for less than £1 on the London Stock Exchange or less than $5 on US-based exchanges. The opportunity to make large profits with a small investment is the goal of many investors.

Antares Pharma (ATRS)

Currently trading for around $4, the company focuses on the development and commercialisation of self-administered parenteral pharmaceutical products. This includes needle-free solutions and transdermal gel technologies. Some of its most popular products include XYOSTED, Otrexup and Sumatriptan.

Healthcare ETFs to watch

Exchange-traded funds are generally considered to be a lower-risk investment than stocks because they provide access to a combination of shares, diversifying your trading portfolio and spreading risk across multiple assets with one single position. Below is a list of popularly traded healthcare ETFs from large investment management firms:

Open an account to start spread betting or trading CFDs on our wide range of healthcare stocks and ETFs.

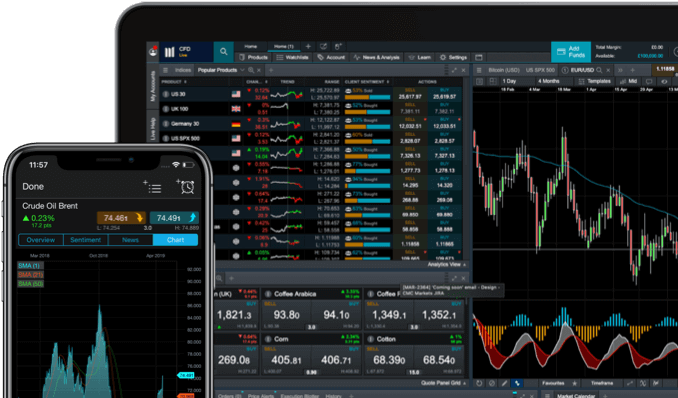

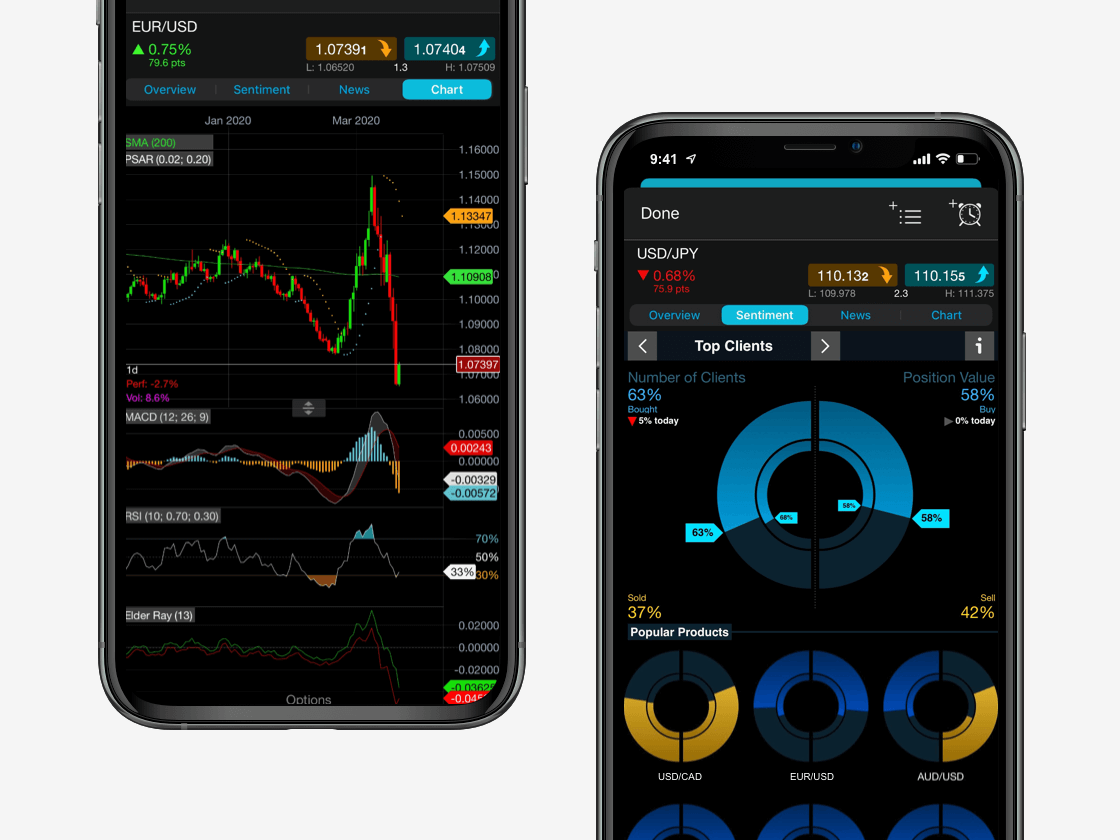

Trade healthcare stocks on the go

Seamlessly open and close trades, track your progress and set up alerts

Should you invest in healthcare stocks?

As previously mentioned, due to the Covid-19 pandemic, the healthcare industry has gained increasingly greater attention. That is why investing in or trading on healthcare stocks is considered by many to be an effective way to diversify your portfolio and to ride the wave of the healthcare industry while it is at its peak.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.