Trading the FTSE 100

Stock indices within the financial markets are a collection of shares that represent a particular sector or benchmark within a country, or in some cases, on a global level. The FTSE 100 is an example of this. This stock index measures the top 100 companies listed on the London Stock Exchange (LSE) with the highest market capitalisations.

The FTSE 100 or the “footsie” is one of the top stock indices in the world, and it is equivalent to the United States’ S&P 500 or Japan’s Nikkei 225 index. These all represent a benchmark for their country’s stock exchange. Large-cap stocks are often attractive to traders, given their relatively reliable and stable cash flows, balance sheets and reputation, along with the ability to reward investors with dividend payouts. For this reason, the FTSE 100 is one of the most popular indices to invest in worldwide.

There are a number of methods for trading the FTSE 100, which involve either buying shares or ETFs of the index outright or trading on underlying price movements of the FTSE through derivative products. We explore these in more detail below.

Buying FTSE 100 shares

Investors may choose to buy outright shares of the index, which will require them to pay the full value of the position upfront and taking full ownership of the asset. You can also buy or trade FTSE 100 ETFs. Exchange-traded funds work in the same way as shares and can be bought and sold on a stock exchange. By closely tracking the prices of the index, this type of product gives investors exposure to the underlying asset.

FTSE 100 spread betting

Spread betting is a financial derivative product. With spread bets, you can trade tax-free* on the price movements of the underlying stock index without taking ownership of the asset. This means that you can go long or short on the position when necessary. If you think that the value of the index will rise, you could buy or go long, and if you think that the value of the index will fall, you could sell or go short.

Trading FTSE 100 CFDs

CFDs (contracts for difference) are another type of derivative product that does not involve taking direct ownership of the asset. A CFD is an agreement to exchange the difference in price of an asset between the opening and close of a contract. Both spread bets and CFDs are leveraged products, which means that you will make a profit if the market moves in your favour, but if the market moves against your position, this will result in equally large losses.

Regardless of the product that a trader chooses in order to gain access to FTSE shares, they should always consult their risk management strategy before opening any positions.

Join a trading community committed to your success

FTSE trading strategies

Many investors tend to buy shares outright or trade the FTSE 100 in the long term, which is a strategy known as position trading. This is because the index is known for being slightly more stable, in comparison with other more volatile assets, and these types of stocks can generally provide profitable returns over a longer period of time. However, some traders prefer to stick with short-term strategies, such as day trading. A day trading strategy involves traders dipping in and out of the market to take advantage of very small but frequent price fluctuations, and closing out their positions at the end of each day to make a profit.

As the FTSE consists of a large number of stocks, there may be less internal volatility. For example, if the performance of one stock declines, there are still 99 other stocks to help to offset risk. Therefore, traders can read and interpret price action on a price chart, and day trading can be a rewarding strategy for experienced traders who are familiar with the FTSE 100. However, the FTSE can still fluctuate rapidly in price due to external events, such as the political and economic instability of the country. In turn, this could have an effect on the entire index’s value, regardless of how many assets there are to offset the decline of a large constituent’s performance.

FTSE performance

Companies that are listed on the FTSE 100 have some of the largest market capitalisations in the world and are leaders within their respective industries. Altogether, the index is valued at approximately £1.52 trillion, as of December 2020, according to the London Stock Exchange (LSE). This highlights the magnitude of the index, along with its share price, which can rise along with its valuation.

List of companies on the FTSE 100

The FTSE 100 index covers all sectors of the stock market. In particular, it features leading companies within the healthcare, technology, retail, consumer goods and energy sectors. Pharmaceutical stocks are a notable contributor to the FTSE 100, as well as raw material suppliers, such as oil, gas and mining stocks. Below are some examples of the biggest FTSE 100 companies in the UK, according to their industry:

- Healthcare: AstraZeneca, GlaxoSmithKline

- Mining: BHP, Rio Tinto

- Oil & Gas: BP, Royal Dutch Shell

- Consumer Goods: British American Tobacco, Unilever

- Finance: Hargreaves Lansdown, Barclays

- Aerospace: BAE Systems, Rolls-Royce

FTSE trading hours

FTSE 100 trading hours usually depend on the stock market trading hours for the London Stock Exchange, which are between 08.00 and 16.30. However, trading hours also depend on each individual broker, as some offer FTSE weekend trading. Some brokers also offer futures (or forward) contracts. These are agreements between a buyer and seller to trade the asset at a future date and price, allowing you to speculate on the price of the stock index over-the-counter, rather than through an exchange. Using forward contracts, you are able to trade outside of LSE hours.

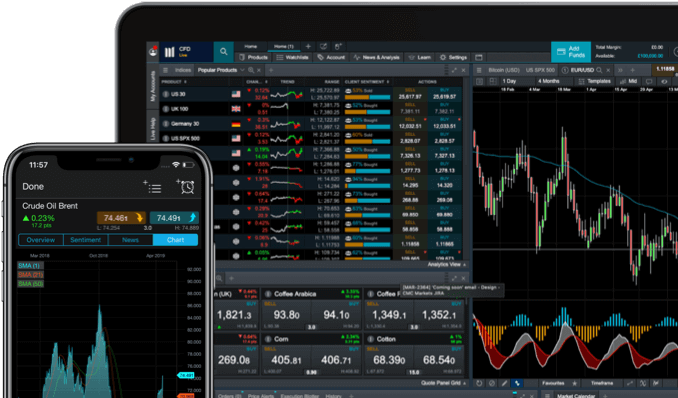

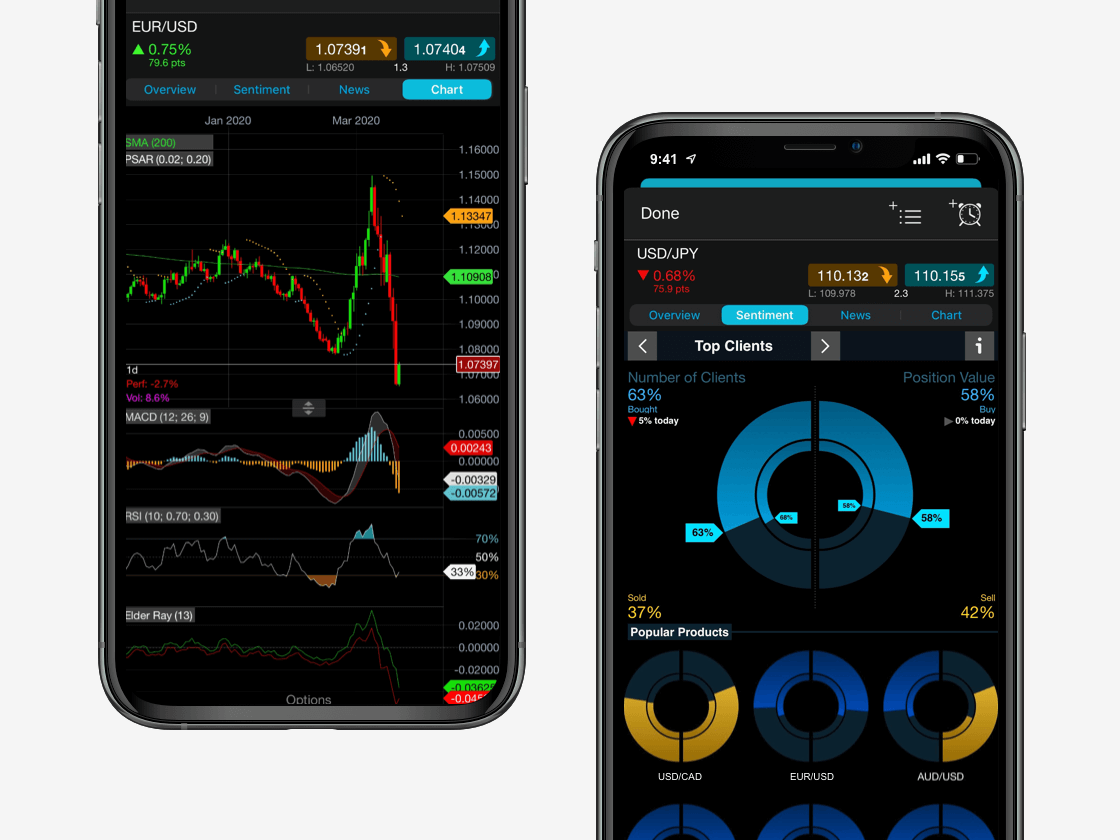

Trading indices with CMC Markets

Clients can trade derivative products on our platform, namely spread bets and CFDs, in order to gain exposure to the underlying performance of a number of stock indices. This includes our UK 100 index, whose price is based upon constituents of the FTSE 100.

Powerful trading on the go

Seamlessly open and close trades, track your progress and set up alerts

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.