A bull trap can occur when the price of an asset rises above a resistance level, luring in more buyers as they chase the upside breakout. The buying tends to be short-lived, though, and the price may tumble shortly after. It’s called a trap because those ‘bulls’ who bought in as the price was breaking out to new highs must exit or face mounting losses as the price reverses course and declines. Bull traps can be costly for those who get caught but potentially profitable for those who understand what is happening and use this knowledge to trade them.

Bull traps tend to occur in downtrends or bear markets when prices start to rise. Buyers may view the rise as a possible end to the downtrend. A technical signal, such as the price moving above a resistance level, may help to increase that confidence. These buyers could jump in but then quickly become overwhelmed by sellers as the downtrend continues.

While bull traps are typically associated with short-term price rises within a downtrend, a bull trap can also occur in a flat market or near the end of an uptrend.

When the price of the asset moves sideways, periodically, it may attempt to move higher, breaking above the prior high of the price range. If there aren’t enough buyers to keep pushing the price higher, the price may tumble back into the range, trapping those who just bought into a losing trade.

The same thing can happen at the end of an uptrend. As the number of buyers dwindles, the price may push slightly above a prior high point – the trap – only to fall sharply because sellers are becoming more dominant.

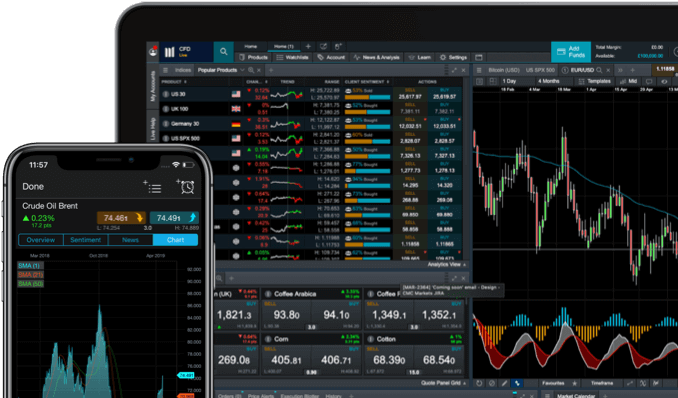

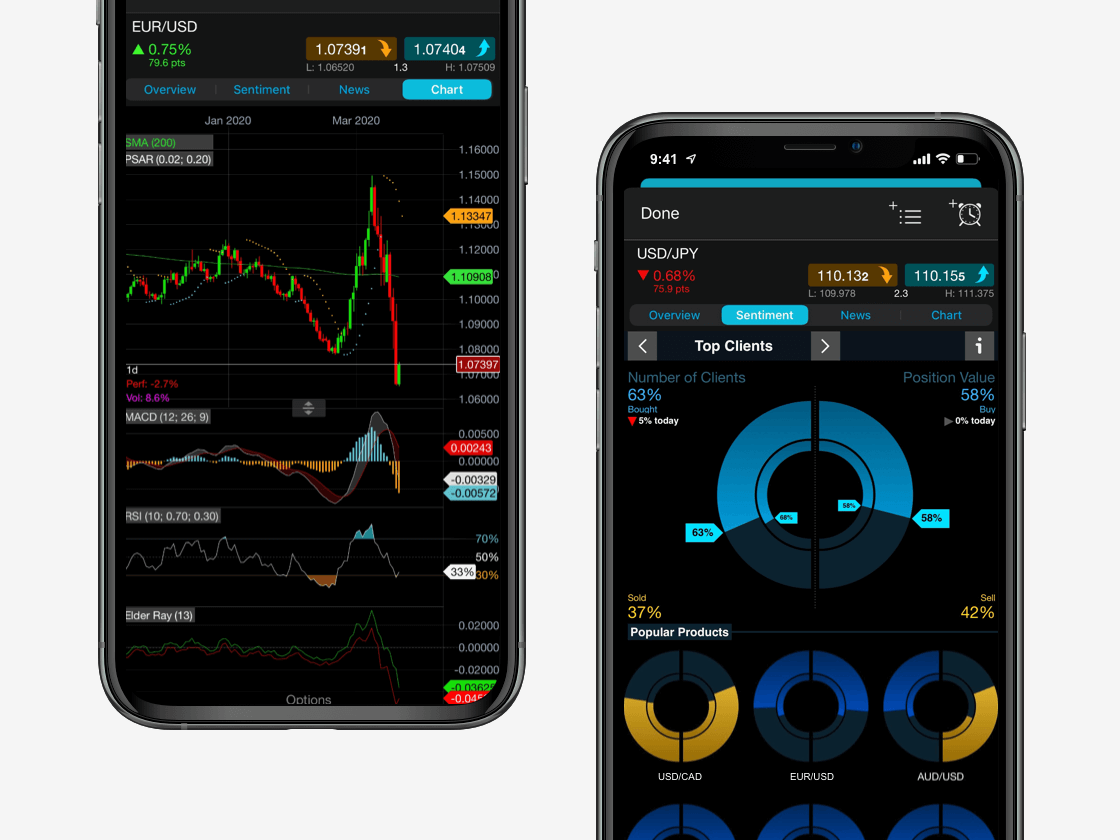

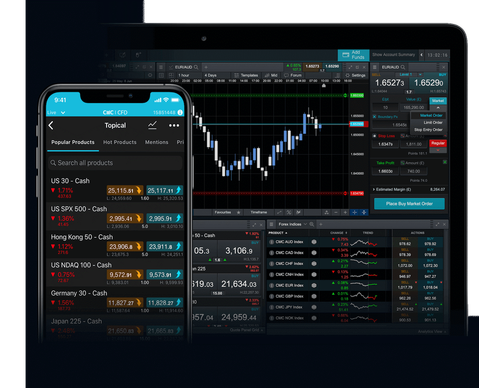

Bull traps can occur in any financial market, including stocks, indices, or forex trading.